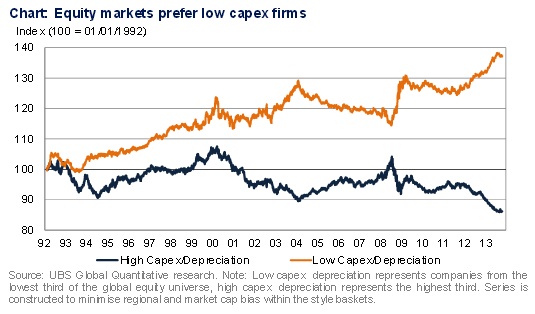

Edward Lam Found amongst some recent market commentary the chart above seems to be quite striking evidence in favour of the Capital as Power framework. The data series have been put together by the investment bank UBS, based on their broad (though not comprehensive) global stock coverage. UBS has charted two lines: a) the stock […]

Continue ReadingThe Weekly Sabotage: Week 1

Tim Di Muzio Welcome to a weekly investigation into the fascinating world of corporate sabotage where human creativity, cooperation, mutual aid and well-being are all held ransom for the profit and power of dominant owners. Every week this column will explore various aspects of what Veblen called ‘strategic sabotage’. But first, a bit of context. […]

Continue ReadingThe Market Disapproves of Rob Ford

DT Cochrane The market has spoken: it disapproves of Rob Ford. A Bloomberg article notes that Toronto’s borrowing costs have risen relative to those of other Canadian municipalities. The determinants of bond prices are complex. Broadly, they translate the confidence of market participants in the ability of the borrower to service their debt. This is […]

Continue Reading