Abstract Neoclassical growth theory is the dominant perspective for explaining economic growth. At its core are four implicit assumptions: 1) economic output can become decoupled from energy consumption; 2) economic distribution is unrelated to growth; 3) large institutions are not important for growth; and 4) labor force structure is not important for growth. Drawing on […]

Continue ReadingStock Buybacks vs Greenfield Investment

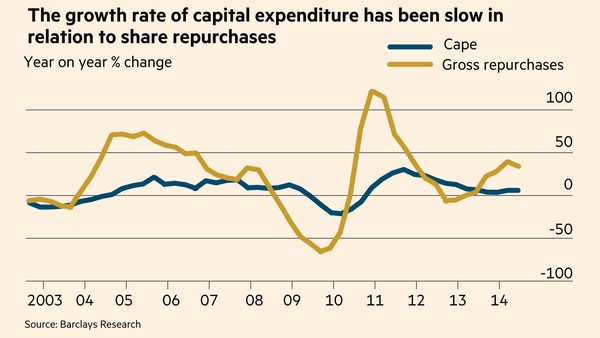

Jonathan Nitzan In his November 29, 2013 piece, ‘Low Capex, High Market Cap: A New High for Corporate Sabotage?’, Edward Lam lends support to CasP’s sabotage thesis by showing how firms with relatively low ‘greenfield’ investment outperform those with relatively high ‘greenfield’ investment. A recent FT article, titled “Money Well Spent?” (Tom Braithwaite, Nicole Bullock […]

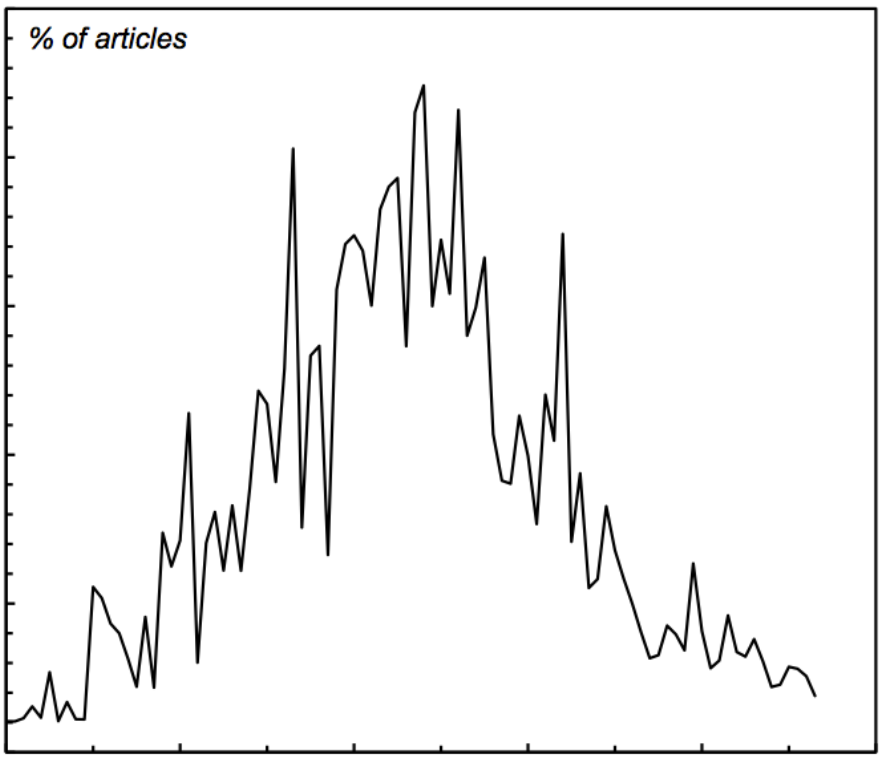

Continue ReadingThe Rise and Fall of Debate in Economics

Joe Francis New data illustrate the extent to which economists have stopped discussing each other’s work. Once upon a time, economists regularly used to publicly criticise each other’s work in academic journals. But not any more. In Figure 1 I have illustrated the degree to which economists have stopped debating. The data have been culled […]

Continue ReadingBaines, ‘Encumbered Behemoth: Wal-Mart, Differential Accumulation and International Retail Restructuring’

Abstract This chapter draws on, and develops, some aspects of the capital as power framework so as to provide the first clear quantitative explication of the company’s power trajectory to date. After rapid growth in the first four decades of its existence, the power of Wal-Mart appears to be flat-lining relative to dominant capital as […]

Continue Reading