Tim Di Muzio Any student of capitalism knows it is a distinct economic system prone to periodic crises. These crises come in many forms and are typically studied after the fact, as the work of Kindleberger and others have demonstrated. But one of the largest mysteries in political economy is the problem of aggregate demand. […]

Continue ReadingHow the Sacklers rigged the game

Originally published at pluralistic.net Cory Doctorow Two quotes to ponder as you read “Purdue’s Poison Pill,” Adam Levitin’s forthcoming Texas Law Review paper: “Some will rob you with a six-gun, And some with a fountain pen.” (W. Guthrie) “Behind every great fortune there is a great crime.” (H. Balzac) (paraphrase) Some background. Purdue was/is the […]

Continue ReadingThe Ritual of Capitalization

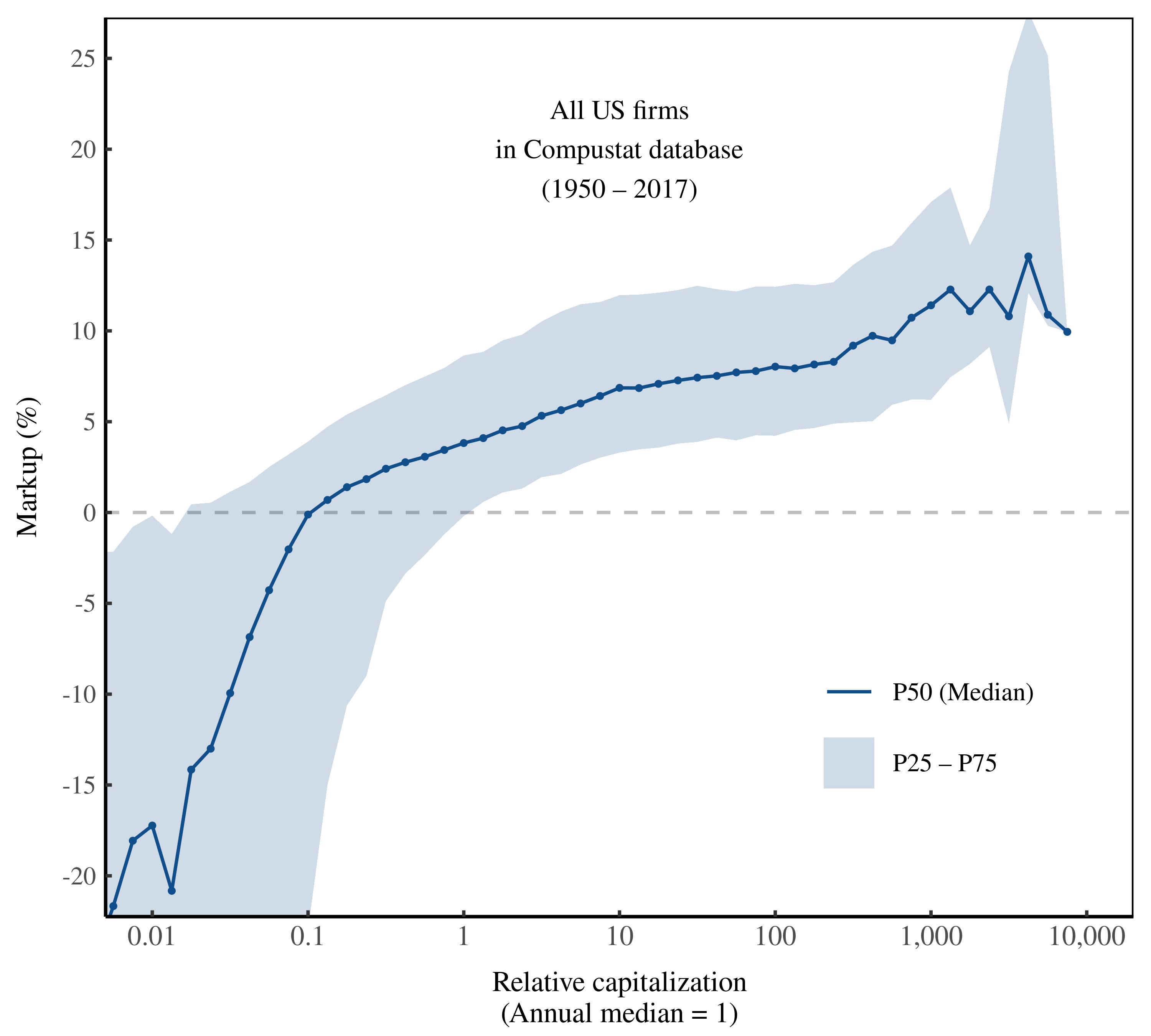

Originally published at Economics from the Top Down Blair Fix There’s something mysterious about finance. The symbols are arcane. The math is complex. The practitioners are impressively educated. And the stakes are high. All of this gives finance the veneer of higher truth — as if quants are uncovering a reality not accessible to the […]

Continue ReadingPatent troll IP is more powerful than Apple’s

Originally published at pluralistic.net Cory Doctorow I was 12 years into my Locus Magazine column when I published the piece I’m most proud of, “IP,” from September 2020. It came after an epiphany, one that has profoundly shaped the way I talk and think about the issues I campaign on. https://locusmag.com/2020/09/cory-doctorow-ip/ That revelation was about […]

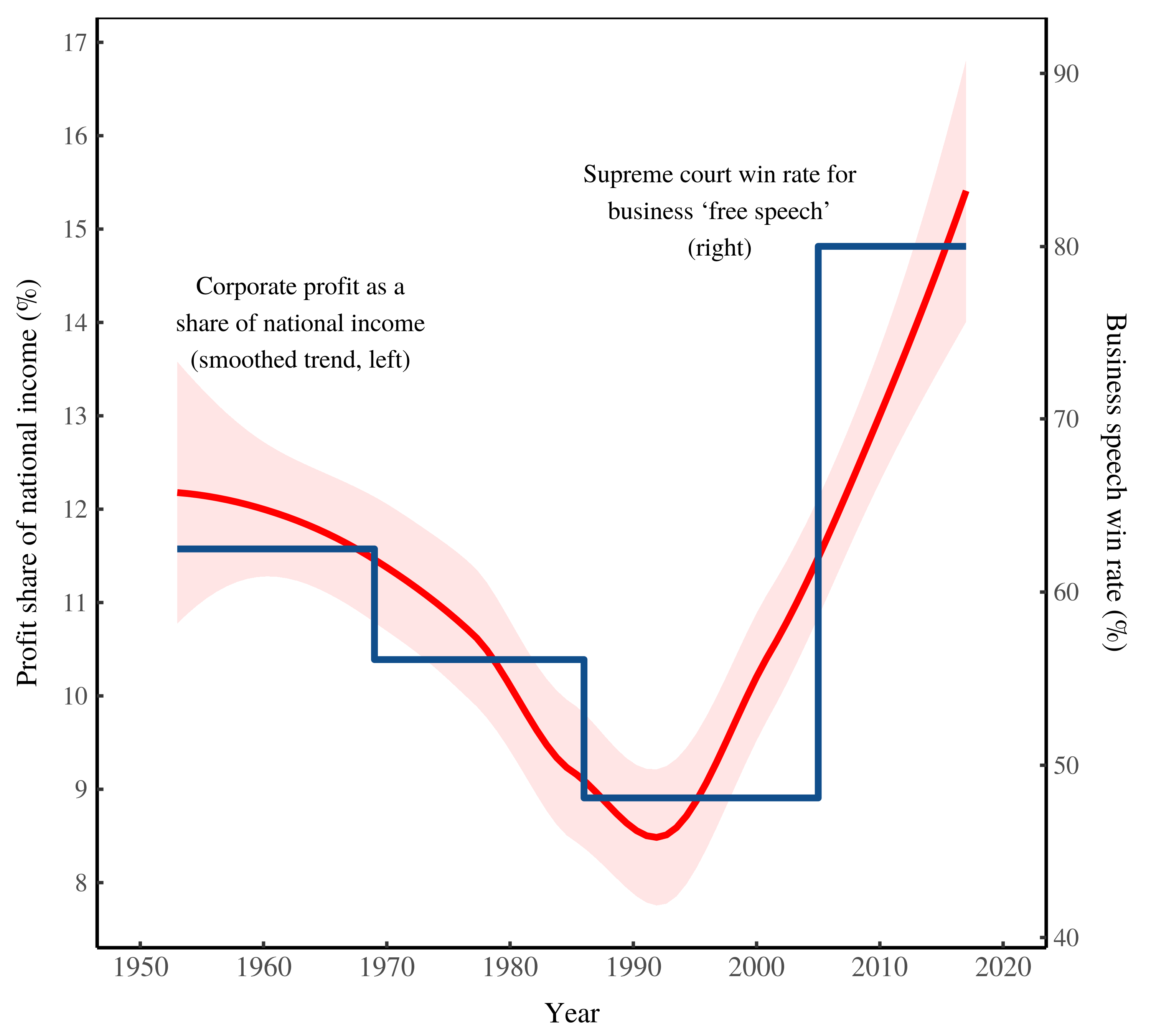

Continue ReadingFree Speech For Me, Not You

Originally published at Economics from the Top Down Blair Fix They say that Americans love two things: freedom … and guns. The trouble with guns is obvious. The trouble with freedom is more subtle, and boils down to doublespeak. When a good old boy defends his ‘freedom’, there’s a good chance he has a hidden […]

Continue ReadingWhen Hollywood defines the limits of good cinema

Originally published at notes on cinema James McMahon On the question of who judges the quality of a film, it is easy to start with a notion that the ultimate judge of a film’s quality is the individual moviegoer. As individual moviegoers, this is often what we think we are doing: we have the autonomy […]

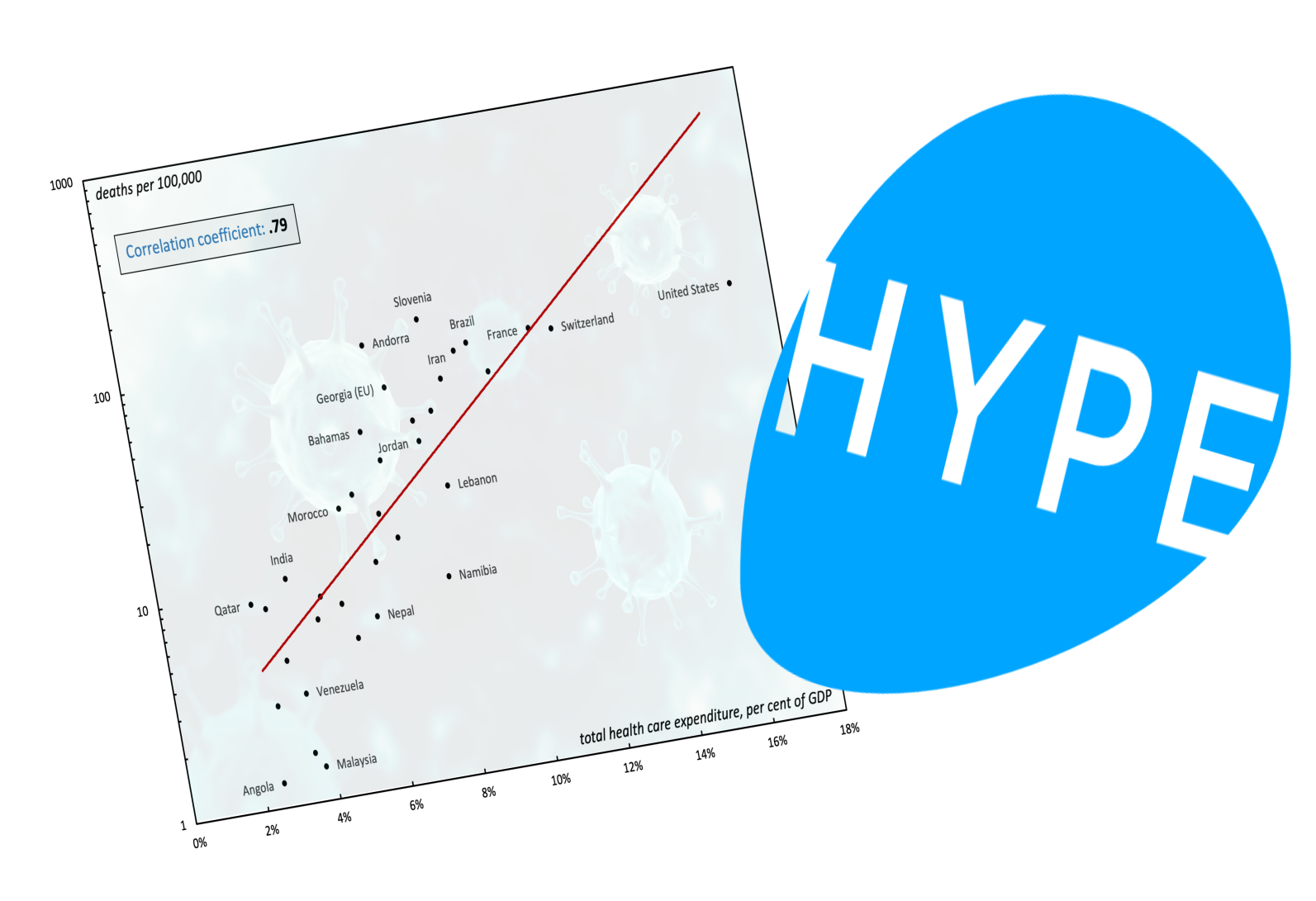

Continue ReadingCapital as Power Essay Prize Winners, 2022

Blair Fix The Review of Capital as Power is pleased to announce the winners of the 2022 Capital as Power Essay Prize: First Prize: ‘Costly Efficiencies: Healthcare Spending, COVID-19, and the Public/Private Healthcare Debate’, by Chris Mouré. Second Prize: ‘Hype: The Capitalist Degree of Induced Participation’, by Yuri Di Liberto. Chris Mouré’s ‘Costly Efficiencies’ In […]

Continue ReadingDuke is academia’s meanest trademark bully

Originally published at pluralistic.net Cory Doctorow Two of the most astute IP scholars I know also happen to be two of the best legal writers I know, and also happen to work at one of the worst IP abusers in the country: Jennifer Jenkins and James Boyle, of Duke University, the nation’s leading academic trademark […]

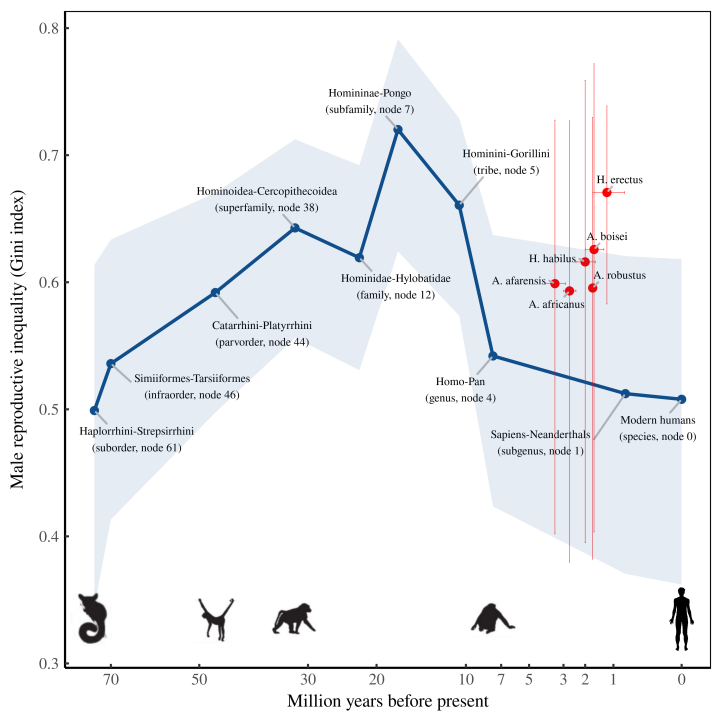

Continue ReadingThe Deep History of Human Inequality

Originally published at Economics from the Top Down Blair Fix Man is born free, yet he is everywhere in chains. — Jean-Jacques Rousseau, 1762 In his epic 18th-century treatise Discourse on Inequality, Jean-Jacques Rousseau argued that inequality is an ill of civilization, created by private property. If you roll back the clock on civilization, he […]

Continue ReadingFord patents plutocratic lane-changes

Originally published at pluralistic.net Cory Doctorow In my 2017 novel WALKAWAY, there’s a scene where the protagonists get into a self-driving car owned by a ruthless plutocrat, only to discover that it moves faster than any other vehicle they’ve ever ridden. https://craphound.com/category/walkaway/ The plute explains that he’s done an illegal mod that lets him override […]

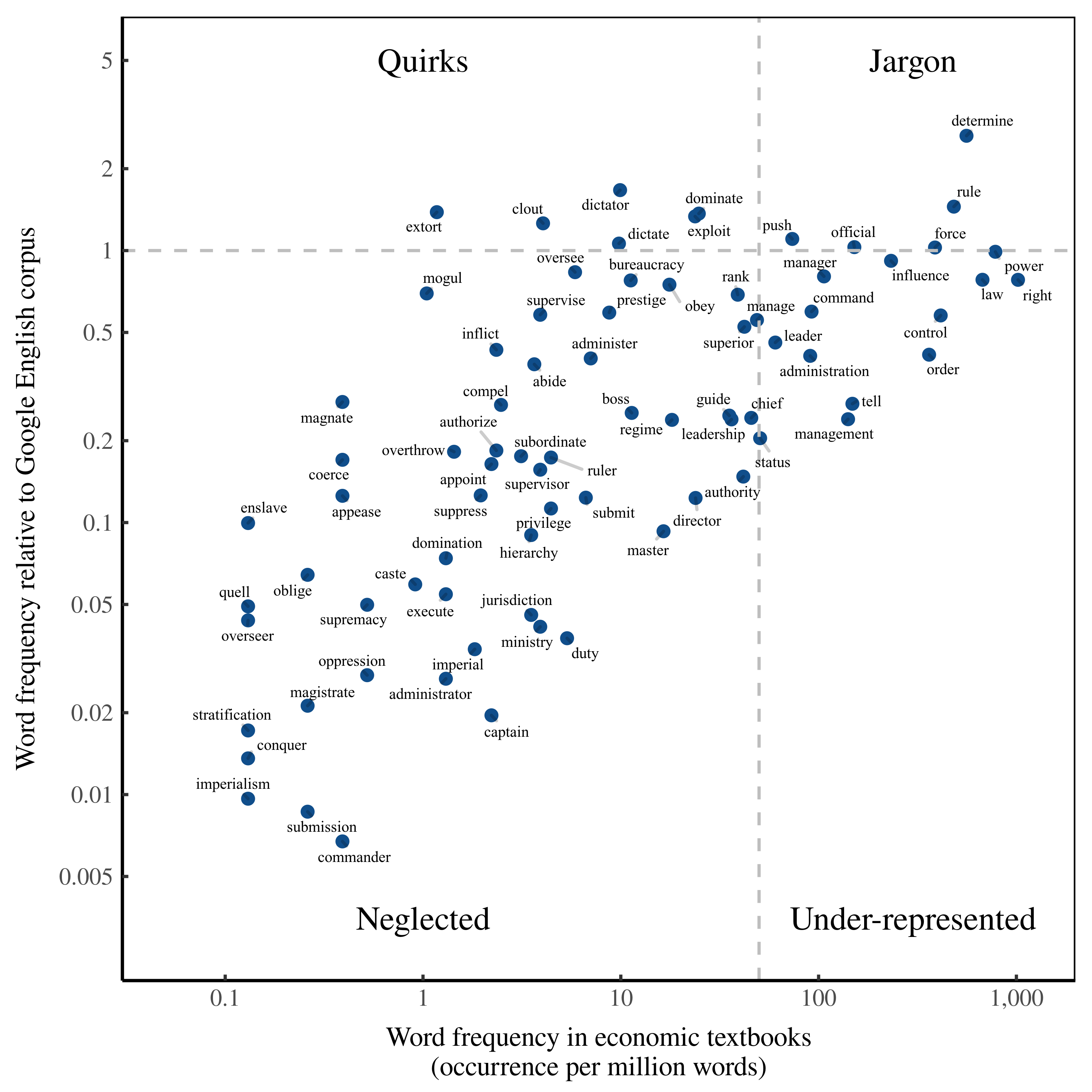

Continue ReadingPower … and the Dialect of Economics

Originally published at Economics from the Top Down Blair Fix A few months ago, I went down a rabbit hole analyzing word frequency in economics textbooks. Henry Leveson-Gower, editor of The Mint Magazine, thought the results were interesting and asked me to write up a short piece. The Mint article is now up, and is […]

Continue ReadingGoogle’s monopoly rigged the ad market

Originally published at pluralistic.net Cory Doctorow The quest to bring antitrust law to bear against tech companies is finally paying off, but it’s been a long, hard slog. At the vanguard have been two legal scholars: Columbia law’s Lina M Khan linamkhan and Yale’s Dina Srinivasan. The first watershed moment was Khan’s Jan 2017 Yale […]

Continue ReadingWhy Are Most Textbooks Still Proprietary?

Originally published at Economics from the Top Down Blair Fix Today a rant about textbooks. Every year governments spend billions of dollars on public education, teaching students knowledge that was itself created by publicly funded research. Yet each year, university students must pay anew for this information by purchasing high-priced textbooks. It needn’t be this […]

Continue ReadingDo all roads lead to the Oscars? Part II

Originally published at notes on cinema James McMahon We ended the last post with a scenario of someone dreaming of their film going all the way to the Academy Awards. But I also waved away any dreamy smoke that clouds our imaginations about this outcome. As was shown in Figure 5, which is pictured below, […]

Continue ReadingThe birth of capitalized credit money is inextricably bound with war

Jonathan Nitzan and Shimshon Bichler Originally published on Twitter During the twilight of feudalism, wars, whose cost soared in tandem with their material scope and unit price, were the most financially demanding expenses. Changing military technologies, beginning with the crusades and continuing with the Hundred Years War, made it increasingly necessary to rely on hired […]

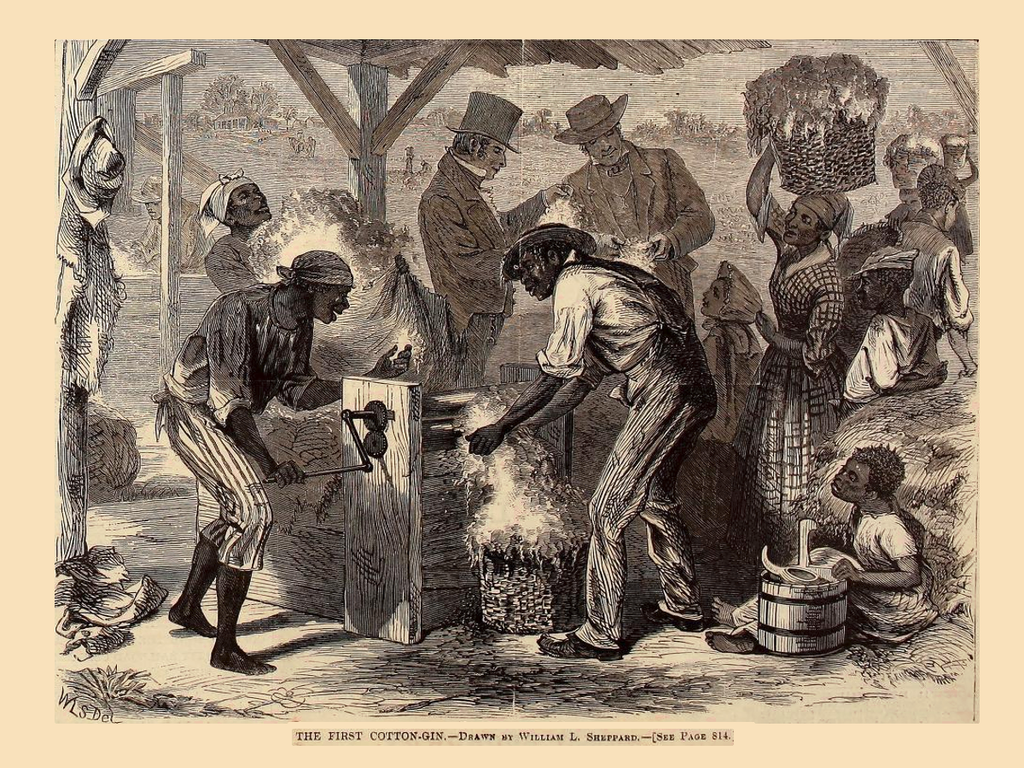

Continue ReadingSlavery, the Development of the United States, and the Case for Reparations

Originally published at joefrancis.info Joe Francis In a new working paper I outline how slavery contributed to the development of the United States before the Civil War. The paper is called ‘King Cotton, the Munificent’ because I argue that slavery benefitted the free society of the North. In a nutshell, I argue that slaves were […]

Continue ReadingAmazon says only corporations own property

Originally published at pluralistic.net Cory Doctorow If you visit Amazon’s Prime Video homepage, you’ll see that the title of that page is “Rent or Buy: Prime Video.” There’s a plain-language meaning of “buy” that most of us understand, but Amazon says we’re wrong. https://www.amazon.com/rent-or-buy-amazon-video/ Amanda Caudel is a Prime user who brought suit against Amazon […]

Continue ReadingEnergizing Exchange: Learning from Econophysics’ Mistakes

Originally published at Economics from the Top Down Blair Fix Let’s talk econophysics. If you’re not familiar, ‘econophysics’ is an attempt to understand economic phenomena (like the distribution of income) using the tools of statistical mechanics. The field has been around for a few decades, but has received little attention from mainstream economists. I think […]

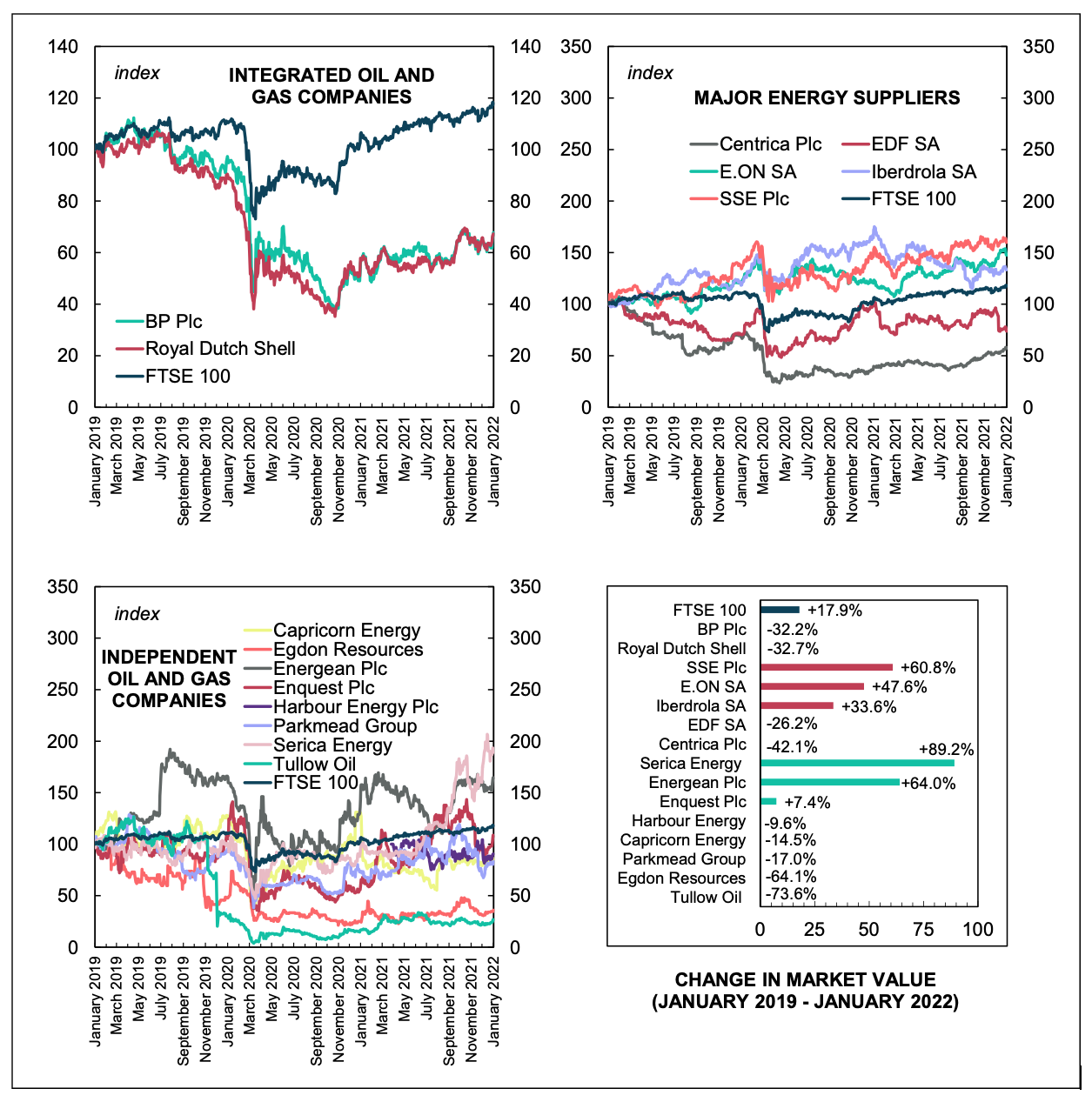

Continue ReadingNew Briefing – Drilling Down: UK Oil and Gas Financial Performance

Originally published at sbhager.com Sandy Brian Hager Joseph Baines and I have a new briefing with Common Wealth examining the financial performance of UK oil and gas producers and energy suppliers. Some of the key findings include: The two UK-headquartered supermajors – BP and Royal Dutch Shell – have remained profitable over the past decade, […]

Continue ReadingCotton and Slavery in Antebellum America

Originally published at joefrancis.info Joe Francis The dominant view among economic historians is that American slavery was an unnecessary evil: nothing good came of it for the development of the United States after independence. Even if some reluctantly accept that the boom in cotton production may have had some benefits for Antebellum America, they argue […]

Continue Reading