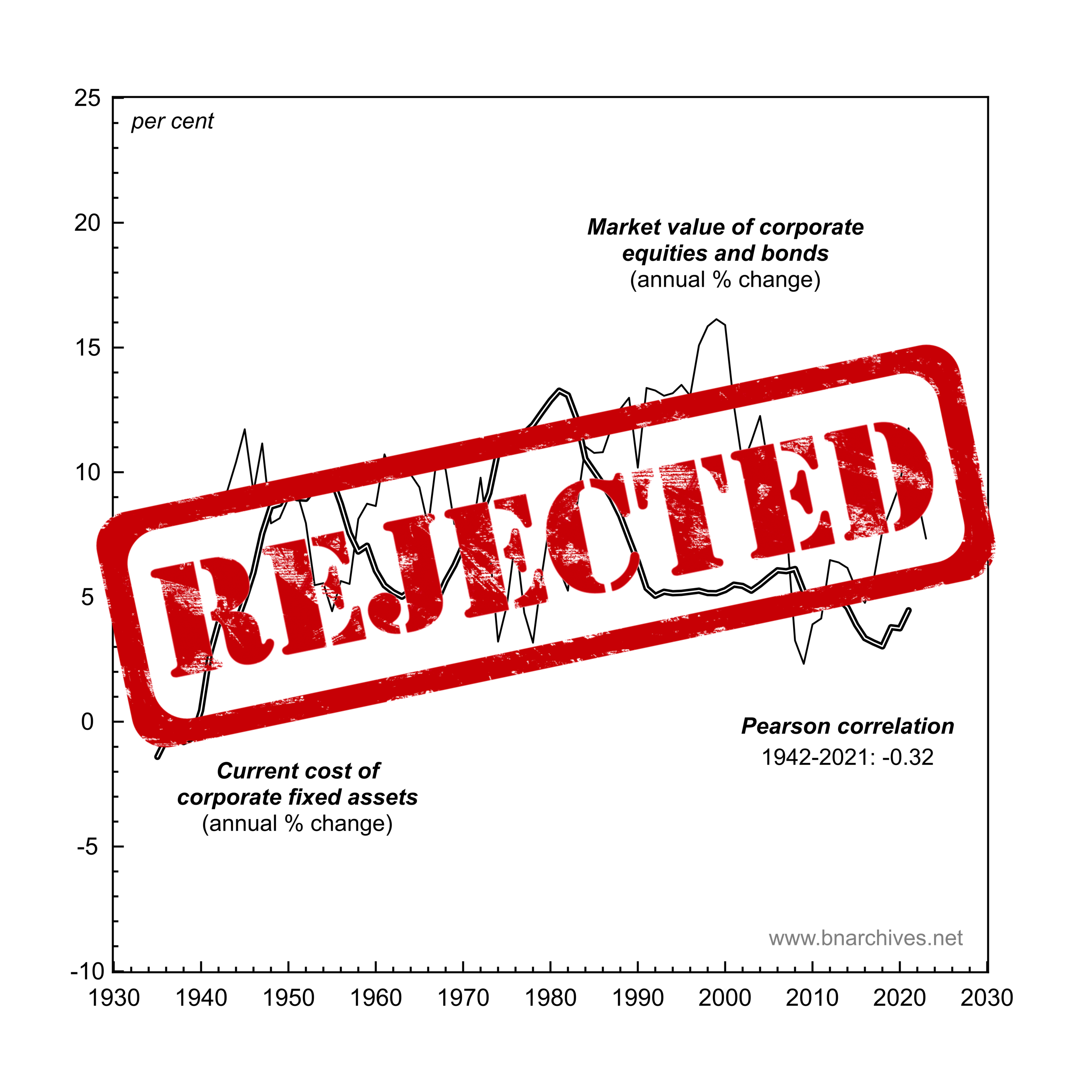

The Capital as Power Approach An Invited-then-Rejected Interview with Shimshon Bichler and Jonathan Nitzan SHIMSHON BICHLER and JONATHAN NITZAN September 2023 Keywords capital accumulation, capitalization, interview, Marxism, modes of power, stagflation, systemic fear, value theory Citation Bichler, Shimshon, and Nitzan, Jonathan. 2023. ‘The Capital as Power Approach: An Invited-then-Rejected Interview with Shimshon Bichler and Jonathan […]

Continue ReadingRoy, ‘Capitalizing a Cure: How Finance Controls the Price and Value of Medicines’

Abstract Capitalizing a Cure takes readers into the struggle over a medical breakthrough to investigate the power of finance over business, biomedicine, and public health. When curative treatments for hepatitis C launched in 2013, sticker shock over their prices intensified the global debate over access to new medicines. Weaving historical research with insights from political […]

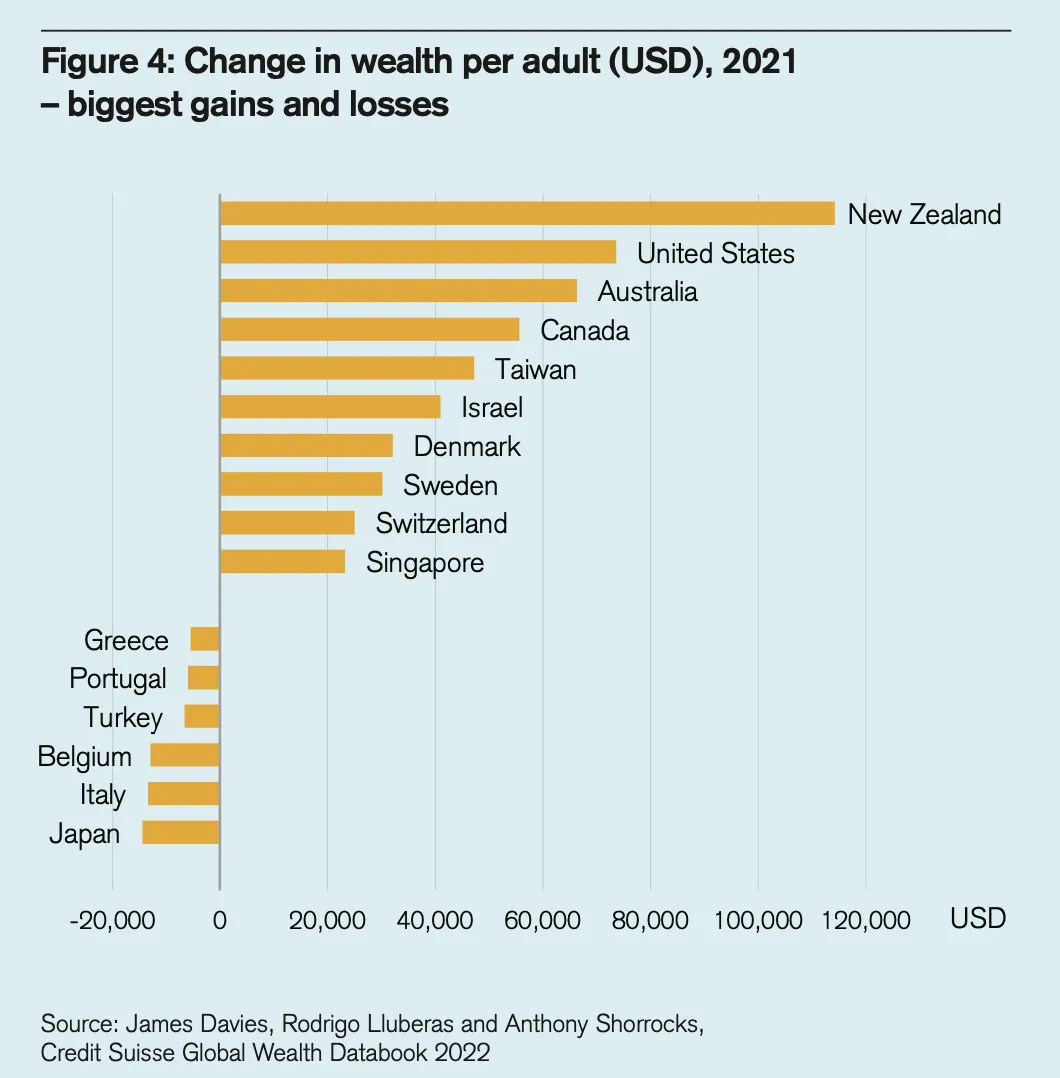

Continue ReadingDo we believe that the average Chinese adult is “wealthier” than the average European?

Originally published at Fresh Economic Thinking Cameron Murray Do you believe this headline? I don’t. The many problems with measuring a country’s wealth are on full display in this Credit Suisse report. But let’s start a little closer to home. When I married my wife I promised to look after her financial and material needs. […]

Continue ReadingThe birth of capitalized credit money is inextricably bound with war

Jonathan Nitzan and Shimshon Bichler Originally published on Twitter During the twilight of feudalism, wars, whose cost soared in tandem with their material scope and unit price, were the most financially demanding expenses. Changing military technologies, beginning with the crusades and continuing with the Hundred Years War, made it increasingly necessary to rely on hired […]

Continue ReadingFix, ‘Das Ritual der Kapitalisierung (The Ritual of Capitalization)’

Abstract Wenn man genau hinhört, kann man zuhören, wie Jeff Bezos immer reicher wird. Da ist es schon wieder, dieses Geräusch. Eine weitere Milliarde in Bezos‘ Kassen. Lassen Sie uns diesen Klang des Geldes mit ein paar Zahlen belegen. Seit 2017 ist das Nettovermögen von Bezos um etwa 4 Millionen Dollar pro Stunde gewachsen – […]

Continue Reading2021/06: Bichler & Nitzan, ‘The Capitalist Degree of Immortality’

Abstract This note offers some speculative ideas worth considering. One of the key features of all hierarchical civilizations is their rulers’ fear of death. This fear was famously narrated in the ancient myth of Gilgamesh – the Sumerian king who realized that, like all other humans, he too was destined to die and embarked on […]

Continue ReadingMouré, ‘Soft-wars: A Capital-as-Power Analysis of Google’s Differential Power Trajectory’

Soft-wars A Capital-as-Power Analysis of Google’s Differential Power Trajectory CHRIS MOURÉ October 2021 Abstract The capital as power framework, developed by Jonathan Nitzan and Shimshon Bichler, argues that the aim of business is not ‘profit maximization’ but the differential accumulation of social power. Using this framework as a theoretical starting point, I analyze the differential […]

Continue ReadingFix, ‘The Ritual of Capitalization’

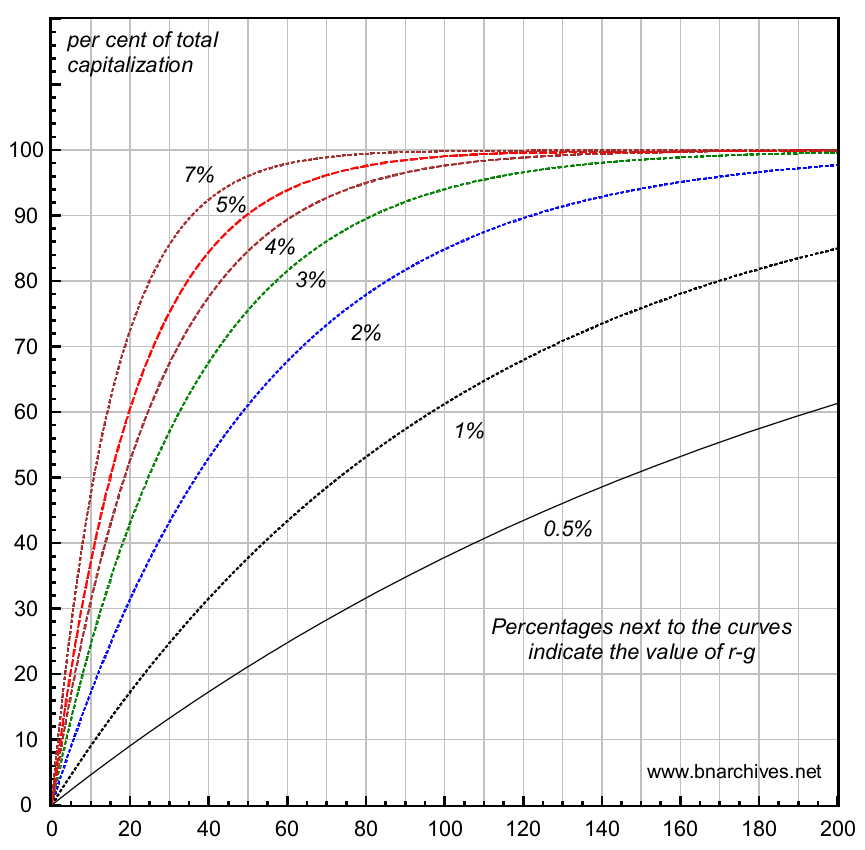

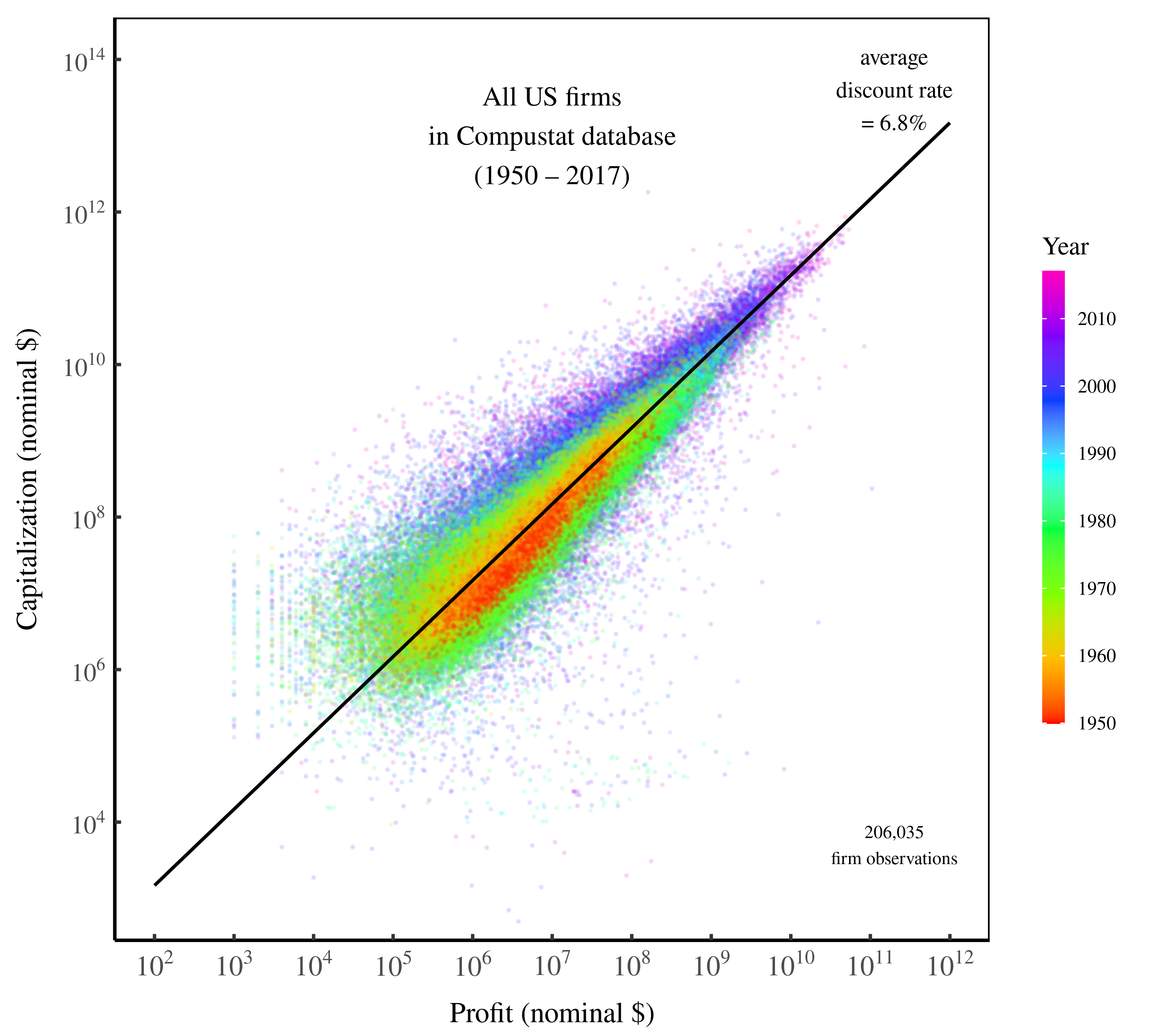

Abstract For more than a century, political economists have sought to understand the nature of capital. The prevailing wisdom is that there must be something ‘real’ — some productive capacity — that underpins capitalized values. This thinking, I argue, is a mistake. Building on Jonathan Nitzan and Shimshon Bichler’s theory of capital as power, I […]

Continue ReadingWhy Scorcese is right about corporate power, Part 2

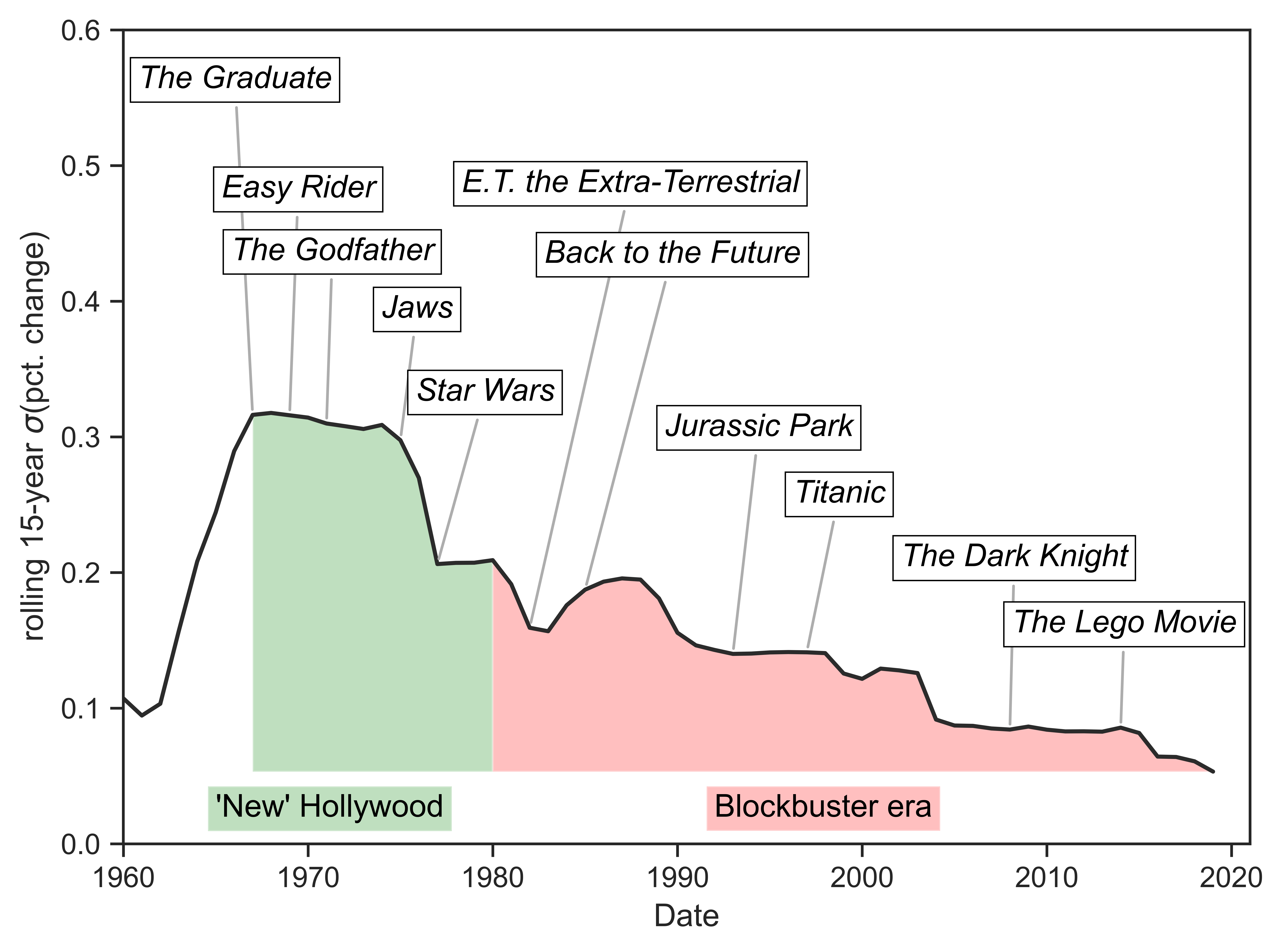

Originally published at notes on cinema James McMahon Part 1 introduced Scorcese’s argument in his Harper’s essay, which was about much more than Fellini. The first part also explained how we can connect Scorcese’s essay to the drive in the Hollywood film business for major film distributors to differentially accumulate, i.e., beat a benchmark that […]

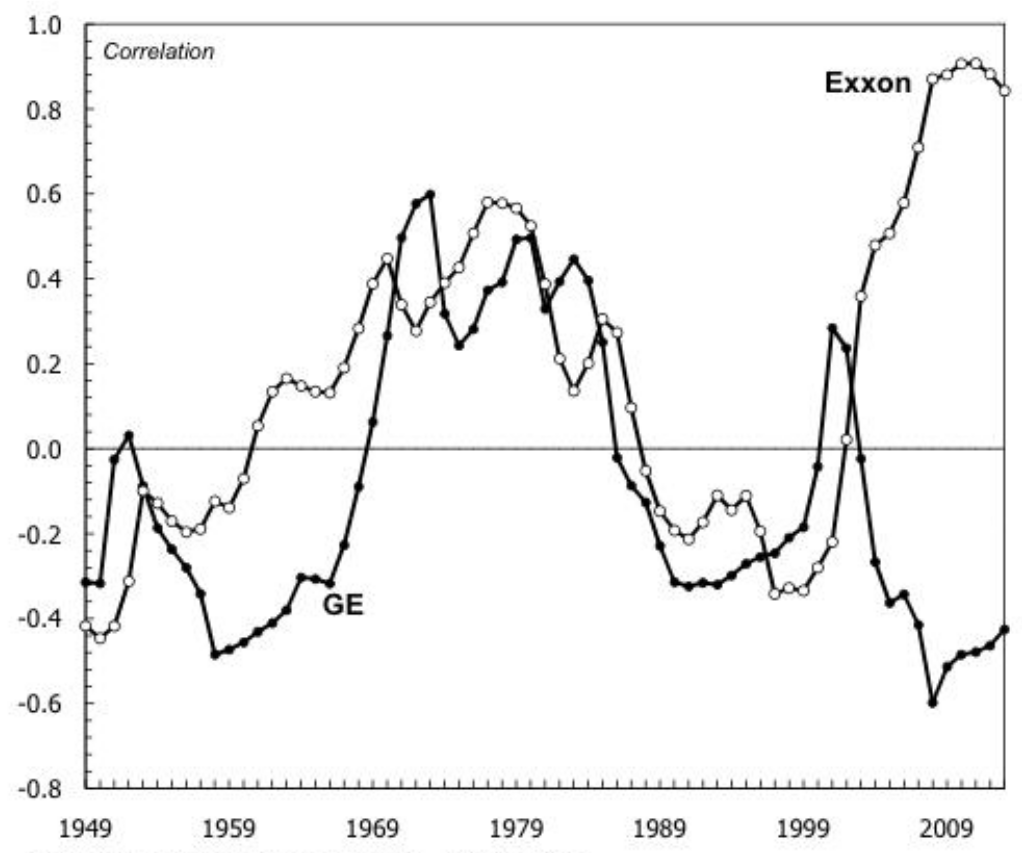

Continue ReadingMcMahon, ‘Reconsidering Systemic Fear and the Stock Market’

Reconsidering Systemic Fear and the Stock Market A Reply to Baines and Hager JAMES MCMAHON August 2021 Abstract This article responds to Baines and Hager’s recent critique of the capital-as-power model of the stock market. Proposed by Bichler and Nitzan, this model seeks to explain how financial crises are tied to the concept of ‘systemic […]

Continue ReadingStocks Are Up. Wages Are Down. What Does it Mean?

Originally published on Economics from the Top Down Blair Fix If you listen carefully, you can hear Jeff Bezos getting richer. There’s the sound again. Another billion in Bezos’ coffers. Let’s put some numbers to this sound of money. Since 2017, Bezos’ net worth has grown by about $4 million per hour — roughly 500,000 […]

Continue ReadingBig money, nuclear subsidies, and systemic corruption

By Cassandra Jeffery1 and M. V. Ramana2 The “largest bribery, money-laundering scheme ever perpetrated against the people and the state of Ohio” came to light during an unexpected press conference in July 2020 in Columbus. Speaking haltingly and carefully, US Attorney for the Southern District of Ohio David DeVillers announced “the arrest of Larry Householder, […]

Continue ReadingPower and Price Construction in Capital as Power

D.T. Cochrane Abstract Perhaps the most contentious concept in Nitzan and Bichler’s power theory of value (CasP), is that of power itself. The contention is rightly placed. The concept has a long, complicated history and its widespread use within the social sciences is a problematic one, in part because its meaning is often taken for […]

Continue Reading2020/04: McMahon, ‘Reconsidering Systemic Fear and the Stock Market: A Reply to Baines and Hager’

Abstract A recent New Political Economy article by Baines and Hager (2020) critiqued Shimshon Bichler and Jonathan Nitzan’s capital-as-power (CasP) model of the stock market (Bichler & Nitzan, 2016). Bichler and Nitzan’s model of the stock market seeks to explain how financial crises are tied to the (upper) limits of redistributing income through power. Bichler […]

Continue ReadingThe Autocatalytic Sprawl of Pseudorational Mastery

The Autocatalytic Sprawl of Pseudorational Mastery ULF MARTIN May 2019 Abstract According to Jonathan Nitzan and Shimshon Bichler (2009), capital is not an economic quantity, but a mode of power. Their fundamental thesis could be summarized as follows: capital is power quantified in monetary terms. But what do we do when we quantify? What is […]

Continue ReadingMartin, ‘The Autocatalytic Sprawl of Pseudorational Mastery ‘

Abstract Winner of the 2018 RECASP Essay Prize According to Jonathan Nitzan and Shimshon Bichler (2009), capital is not an economic quantity, but a mode of power. Their fundamental thesis could be summarized as follows: capital is power quantified in monetary terms. But what do we do when we quantify? What is the nature of […]

Continue ReadingOn the Power Theory of Capitalism and Differential Accumulation

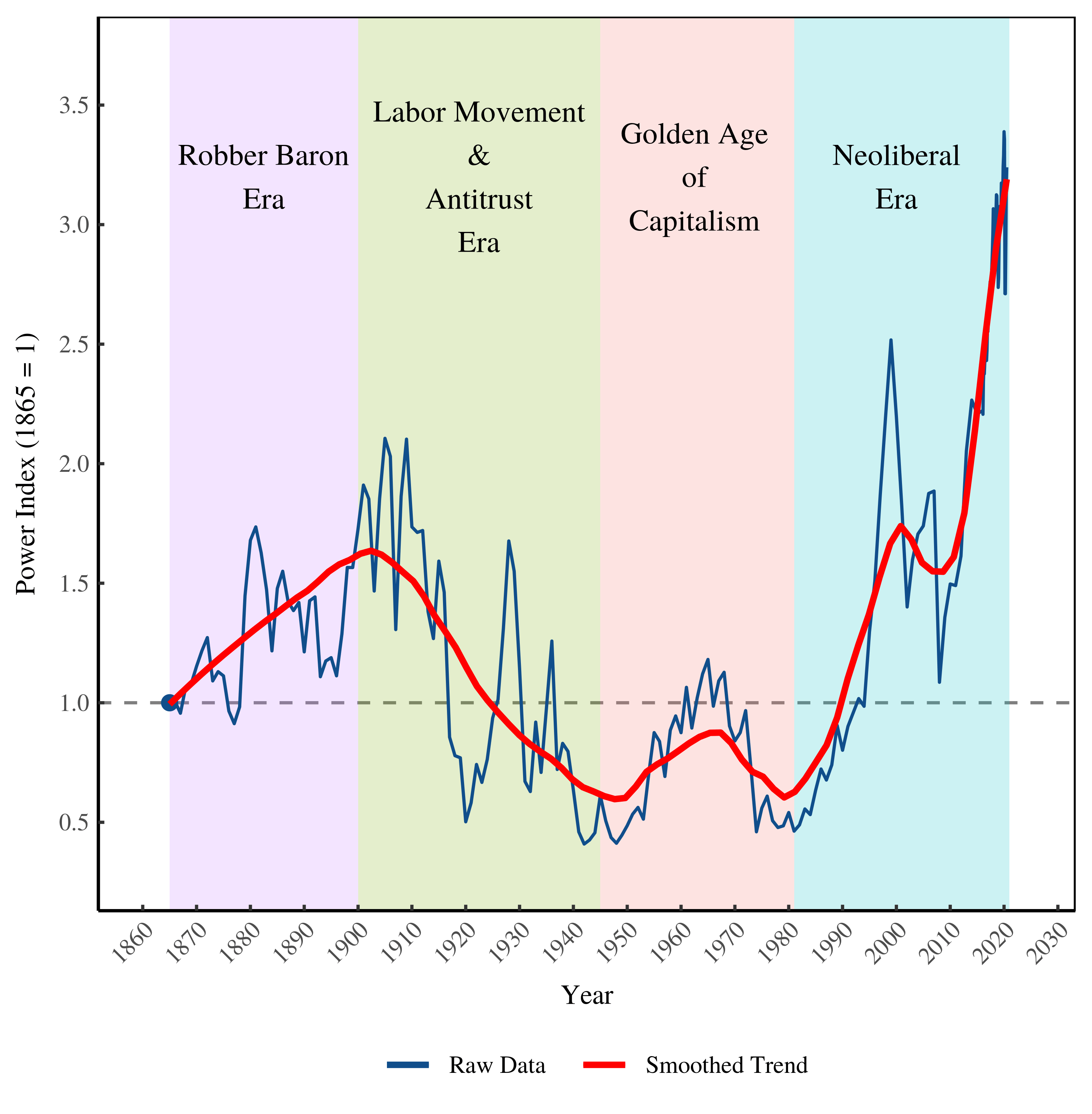

Ken Zimmerman This piece was originally posted on the Real-World Economics Review Blog here and here. Shimshon Bichler and Jonathan Nitzan are Israeli political economists. Together they’ve created a thought-provoking power theory of capitalism and theory of differential accumulation. The theory is not “pie-in-the-sky,” but is based in their analysis of the political economy of […]

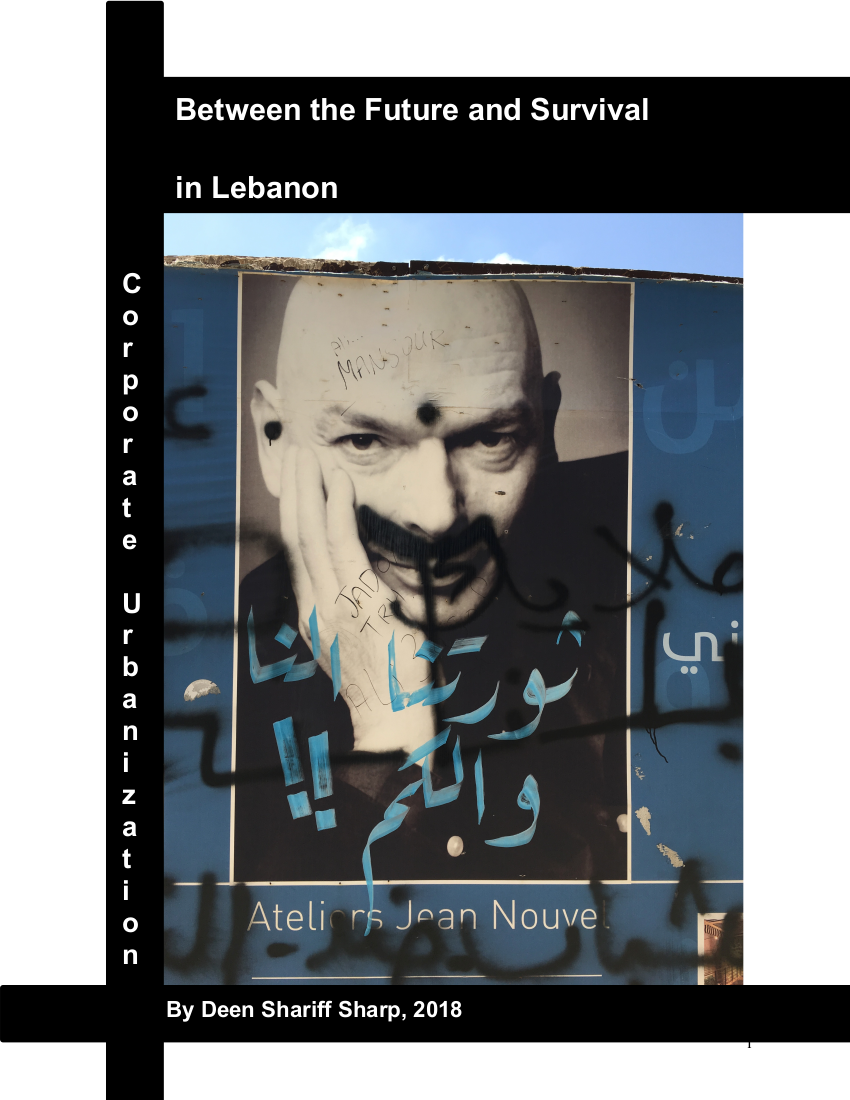

Continue ReadingSharp, ‘Corporate Urbanization: Between the Future and Survival in Lebanon’

Abstract If you look today at the skyline of downtowns throughout the Middle East and beyond, the joint-stock corporation has transformed the urban landscape. The corporation makes itself present through the proliferation of its urban mega-projects, including skyscrapers, downtown developments and gated communities; retail malls and artificial islands; airports and ports; and highways. Built into […]

Continue ReadingBichler & Nitzan, ‘With Their Back to the Future: Will Past Earnings Trigger the Next Crisis?’

Abstract As these lines are being written (April 2018), the The U.S. stock market is again in turmoil. After a two-year bull run in which share prices soared by nearly 50 per cent, the market is suddenly dropping. Since the beginning of 2018, it lost nearly 10 per cent of its value, threatening investors with […]

Continue ReadingMcMahon, ‘Is Hollywood a Risky Business? A Political Economic Analysis of Risk and Creativity’

Abstract This paper seeks to explain why Hollywood’s dominant firms are narrowing the scope of creativity in the contemporary period (1980–2015). The largest distributors have sought to prevent the art of filmmaking and its related social relations from becoming financial risks in the pursuit of profit. Major filmed entertainment, my term for the six largest […]

Continue Reading