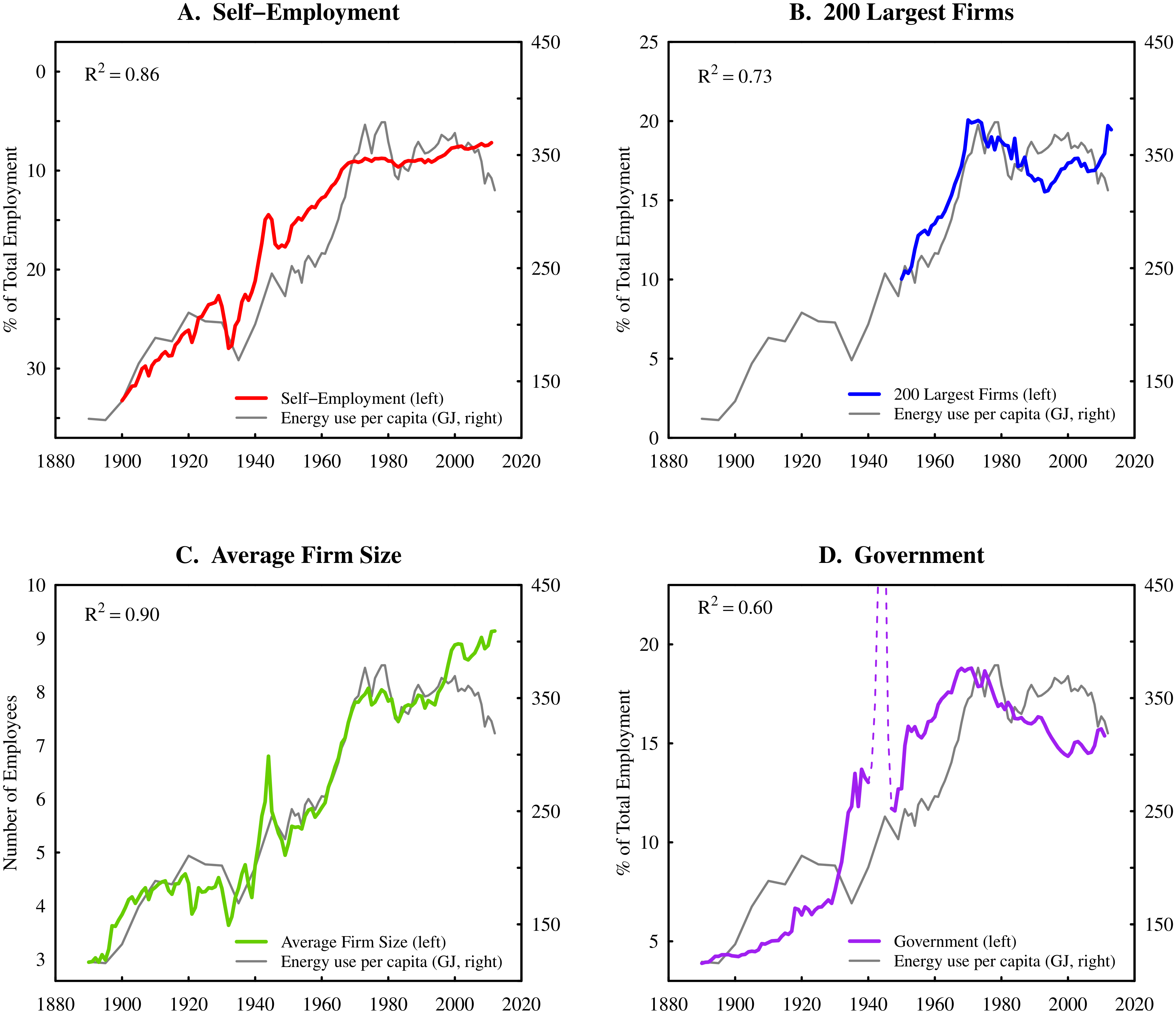

Abstract Why do institutions grow? Despite nearly a century of scientific effort, there remains little consensus on this topic. This paper offers a new approach that focuses on energy consumption. A systematic relation exists between institution size and energy consumption per capita: as energy consumption increases, institutions become larger. I hypothesize that this relation results […]

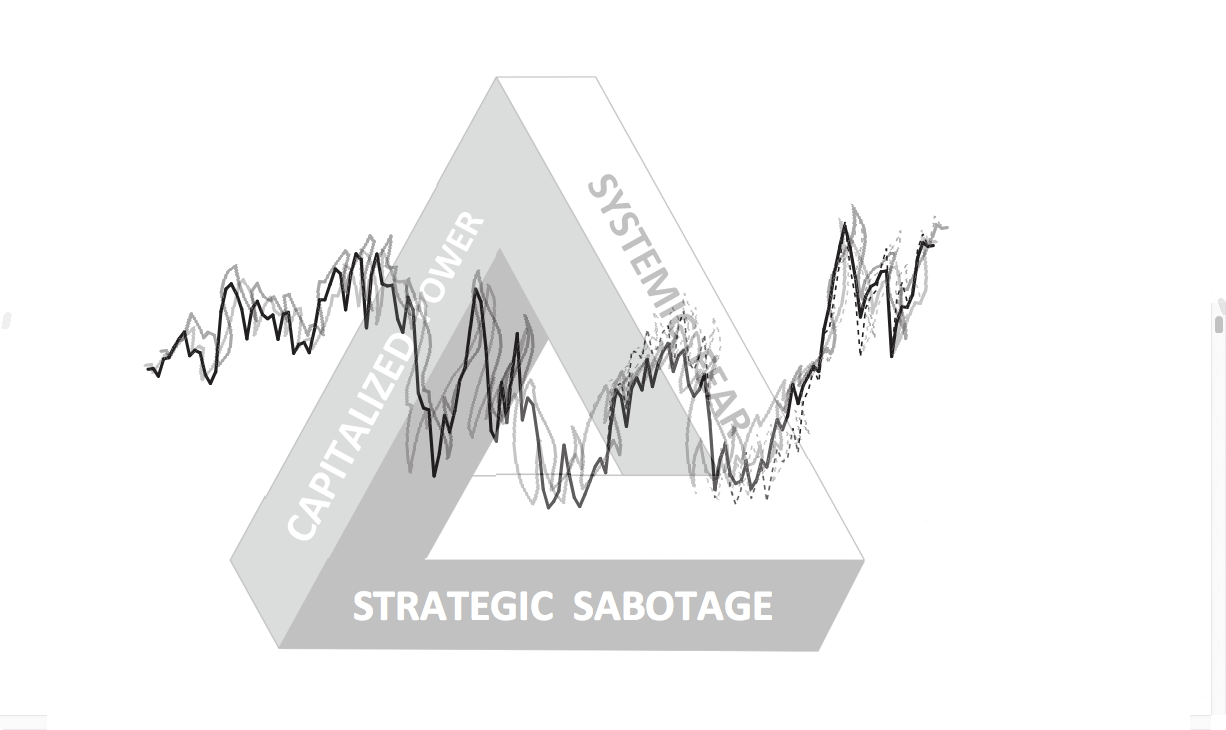

Continue ReadingBichler & Nitzan, ‘A CasP Model of the Stock Market’

Abstract Most explanations of stock market booms and busts are based on contrasting the underlying ‘fundamental’ logic of the economy with the exogenous, non-economic factors that presumably distort it. Our paper offers a radically different model, examining the stock market not from the mechanical viewpoint of a distorted economy, but from the dialectical perspective of […]

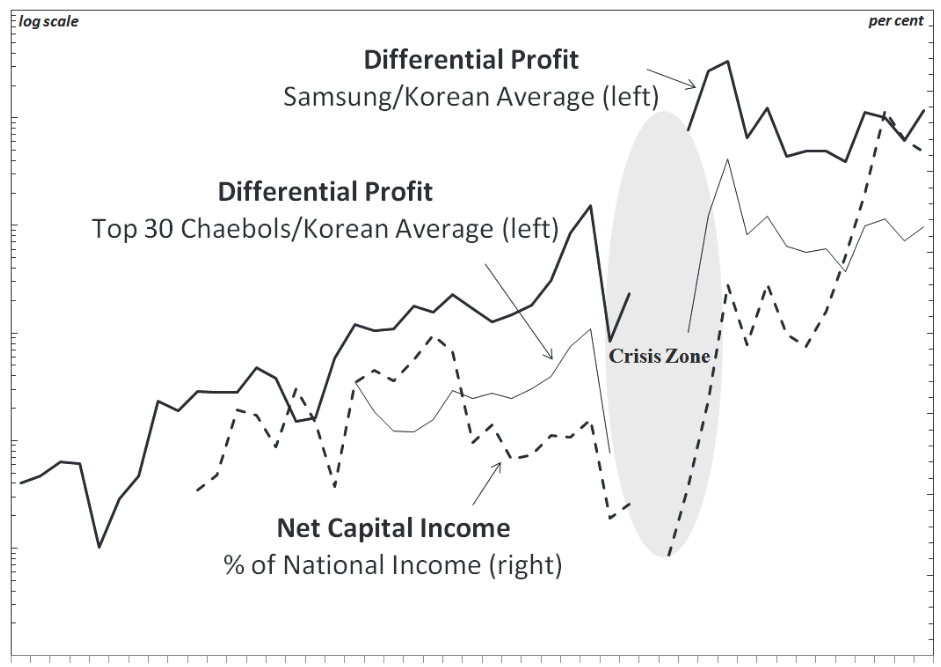

Continue ReadingPark & Doucette, ‘Financialization or Capitalization? Debating Capitalist Power in South Korea in the Context of Neoliberal Globalization’

Abstract The article reviews debates concerning financialization in South Korea, with a focus on ongoing arguments between liberal, post-Keynesian, institutionalist and Marxist economists. It argues that post-Keynesian and institutionalist perspectives in particular neglect important class processes through which the financial circuit operates within the Korean economy, especially the power of Korea’s large, family-led conglomerates, or […]

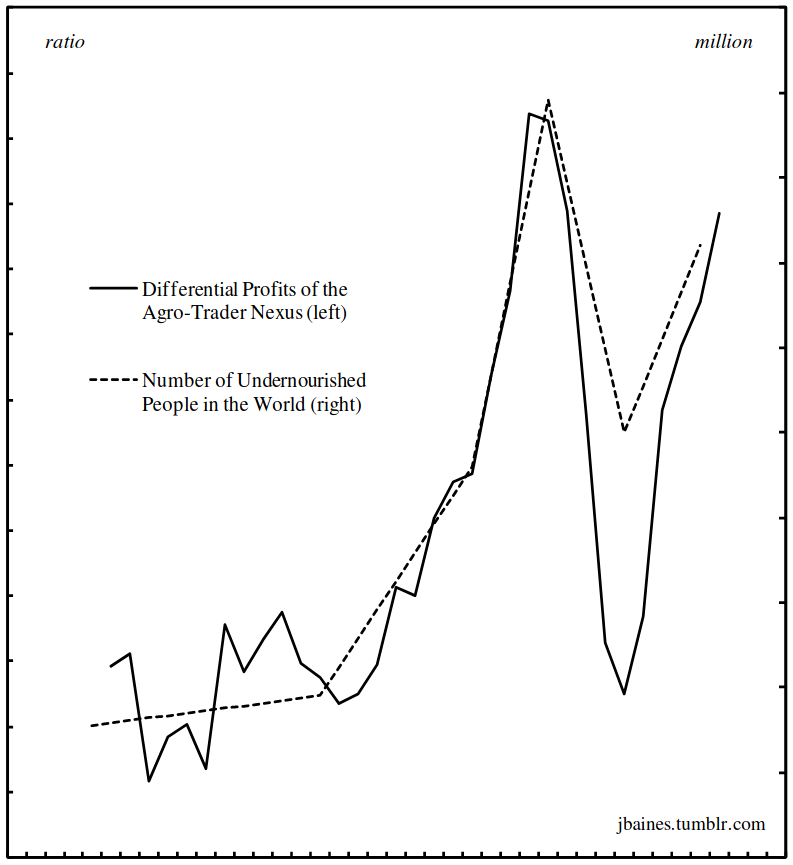

Continue ReadingBaines, ‘Food Price Inflation as Redistribution: Towards a New Analysis of Corporate Power in the World Food System’

Abstract This paper outlines the contours of a new research agenda for the analysis of food price crises. By weaving together a detailed quantitative examination of changes in corporate profit shares with a qualitative appraisal of the restructuring in business control over the organisation of society and nature, the paper points to the rapid ascendance […]

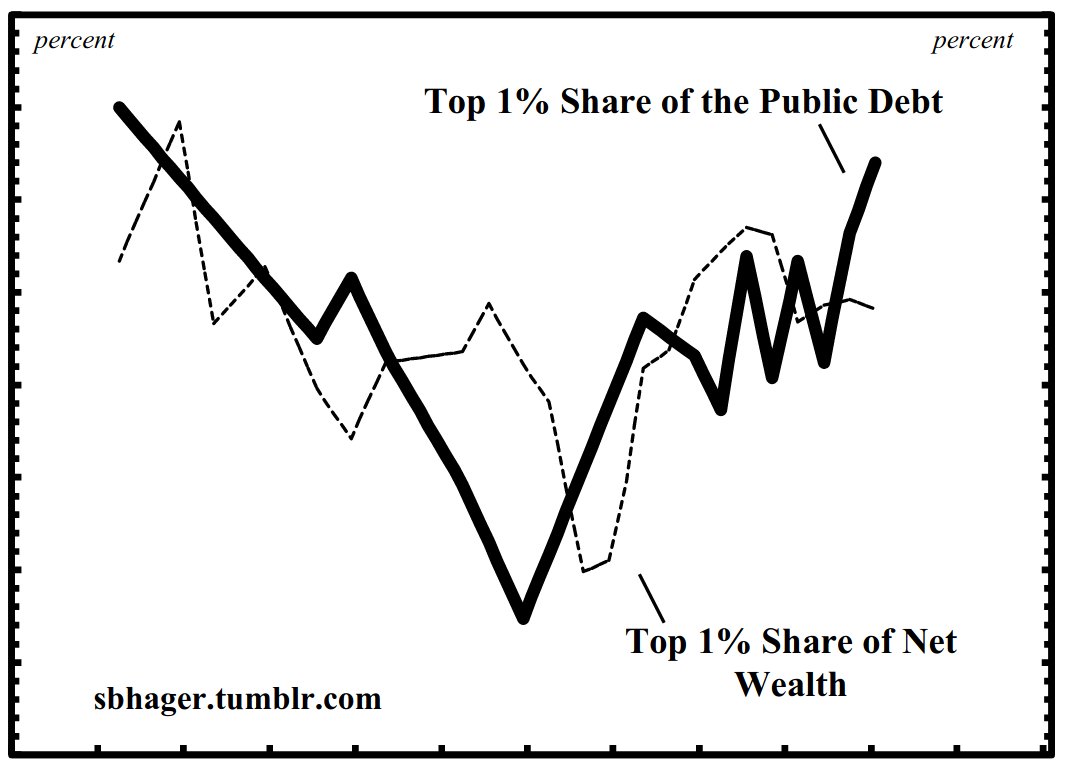

Continue ReadingHager, ‘What Happened to the Bondholding Class? Public Debt, Power and the Top One Per Cent’

Abstract In 1887 Henry Carter Adams produced a study demonstrating that the ownership of government bonds was heavily concentrated in the hands of a ‘bondholding class’ that lent to and, in Adams’s view, controlled the government like dominant shareholders control a corporation. The interests of this bondholding class clashed with the interests of the masses, […]

Continue ReadingMcMahon, ‘The Rise of a Confident Hollywood: Risk and the Capitalization of Cinema’

Abstract This paper investigates the historical development of risk in the Hollywood film business. Using opening theatres as a proxy for future expectations, the paper demonstrates how, from 1981 to 2011, Hollywood has improved its ability to predict the financial rankings of its films. More specifically, the Hollywood film business has become better at predicting […]

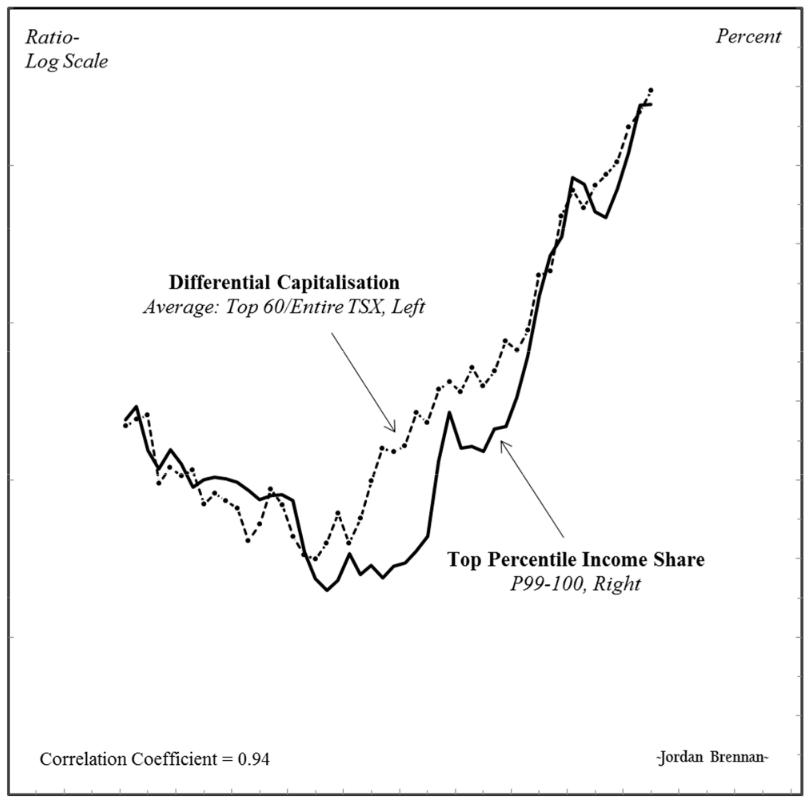

Continue ReadingBrennan, ‘The Power Underpinnings, and Some Distributional Consequences, of Trade and Investment Liberalisation in Canada’

Abstract Criticism of trade and investment liberalisation (TAIL) in North America has drawn attention to weak economic performance, wage-profit redistribution, social dumping and fiscal pressure on government programmes as evidence that the TAIL regime has failed to deliver on some of its key promises. This criticism has been unable, however, to establish satisfactory conceptual and […]

Continue Reading