Jerry Cayford Originally published here A conversation, eighty-some years ago, shaped our world today. The conversation was among three papers in economics. In 1939, Nicholas Kaldor and John Hicks published papers that steered economics through a major crisis, one that threatened its legitimacy as an advisor on public policy. With the Great Depression still raging […]

Continue ReadingBichler & Nitzan, ‘Book Review: Steve Keen (2021) The New Economics: A Manifesto’

Abstract Steve Keen’s book, The New Economics: A Manifesto (2021), offers a new path for economics, and for good reason. In his view, neoclassicism, the paradigm that rules modern-day economics, has become a serious menace: “I regard Neoclassical economics as not merely a bad methodology for economic analysis, but as an existential threat to the […]

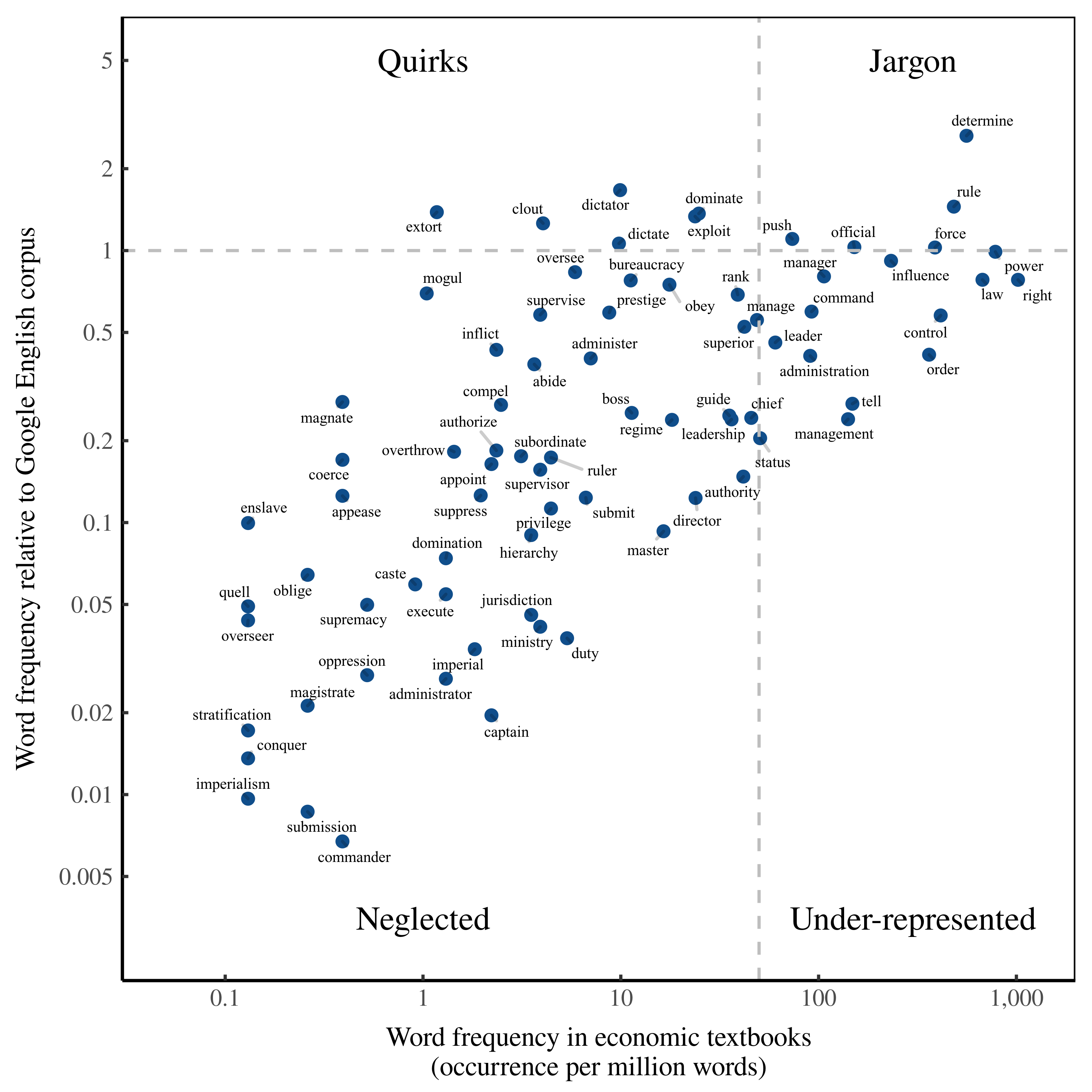

Continue ReadingPower … and the Dialect of Economics

Originally published at Economics from the Top Down Blair Fix A few months ago, I went down a rabbit hole analyzing word frequency in economics textbooks. Henry Leveson-Gower, editor of The Mint Magazine, thought the results were interesting and asked me to write up a short piece. The Mint article is now up, and is […]

Continue Reading2021/07: Bichler & Nitzan, ‘Steve Keen’s The New Economics: A Manifesto’

Abstract Neoclassical economics is the official scientific underpinning of capitalism as well as its main ideological defence, and according to Keen, it fails in both tasks. Contrary to received opinion, neoclassicism cannot explain capitalism – either in detail or in the aggregate – and the policies it prescribes do not support but undermine the very […]

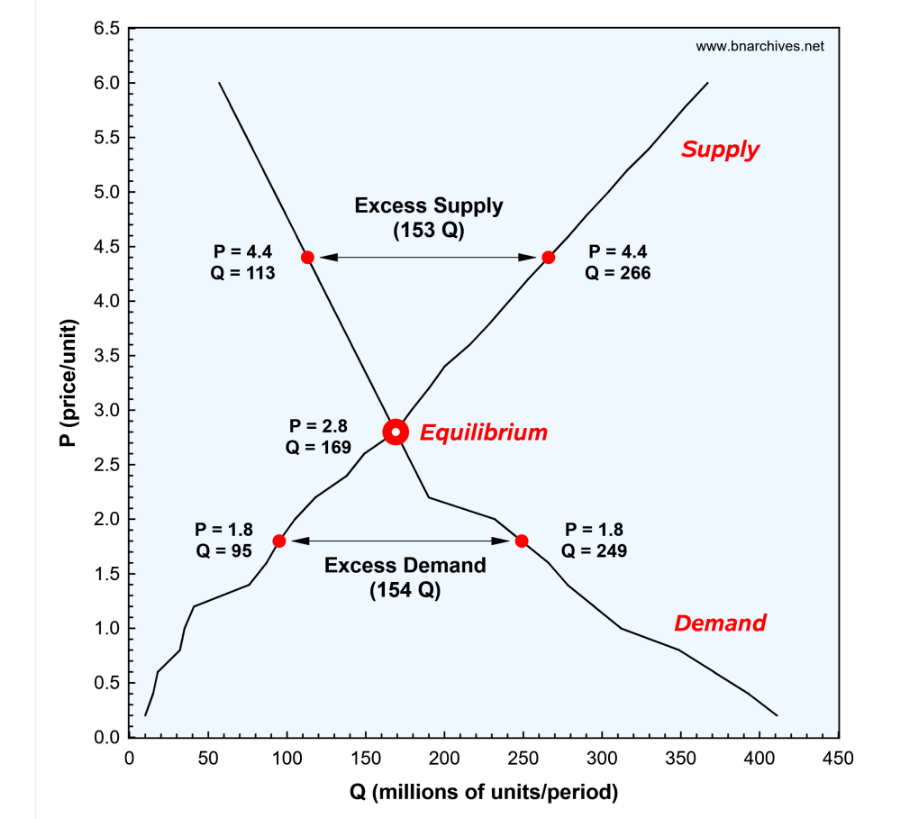

Continue ReadingBichler & Nitzan, ‘The 1-2-3 Toolbox of Mainstream Economics: Promising Everything, Delivering Nothing’

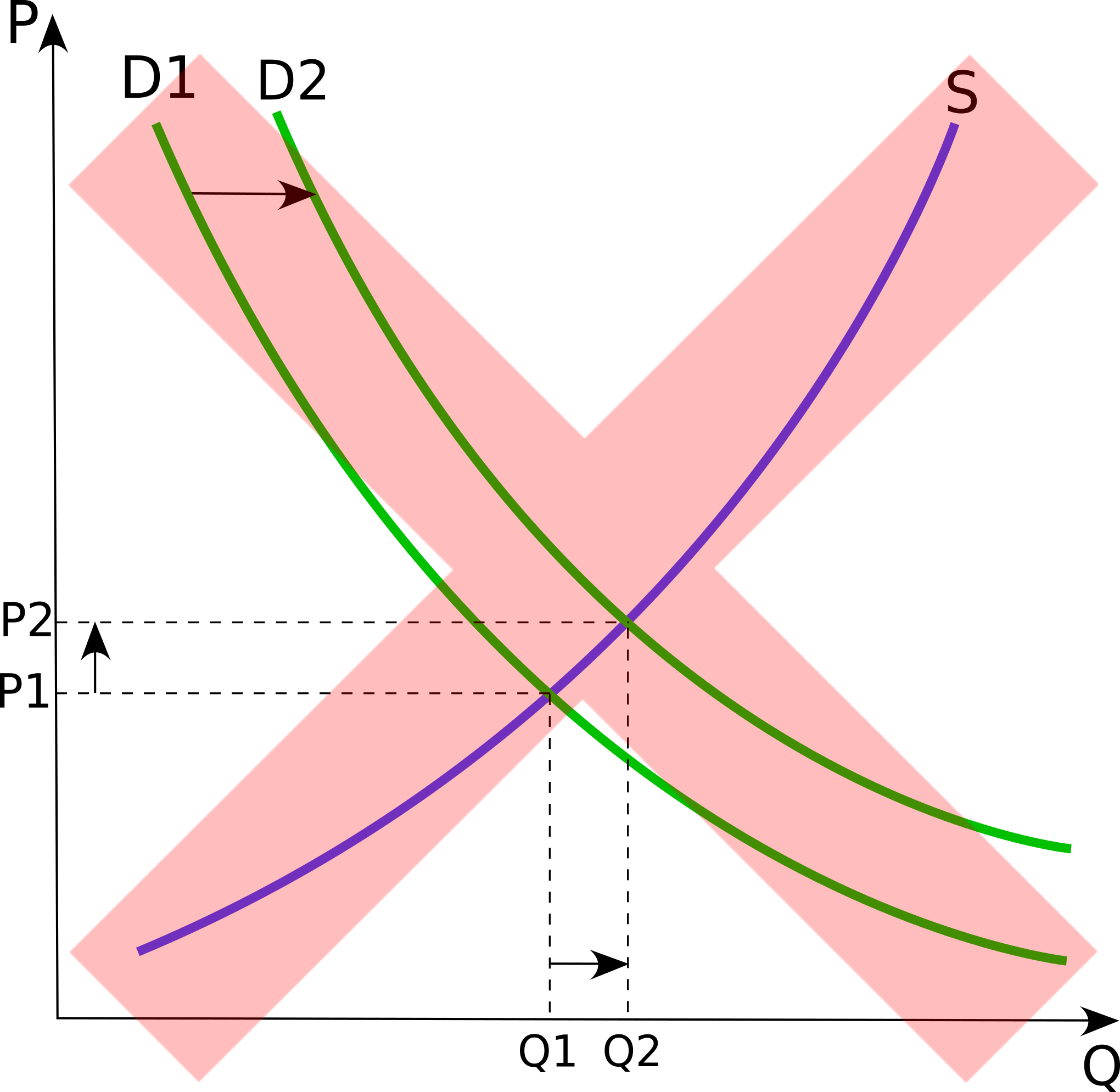

Abstract We write this essay for both lay readers and scientists, though mainstream economists are welcome to enjoy it too. Our subject is the basic toolbox of mainstream economics. The most important tools in this box are demand, supply and equilibrium. All mainstream economists – as well as many heterodox ones – use these tools, […]

Continue ReadingAdvice for an Aspiring Economist

Originally published on Economics from the Top Down Blair Fix A few weeks ago, evolutionary biologist David Sloan Wilson contacted me about an essay series he’s editing called Advice for an Aspiring Economist. The series aims to give advice to students who are interested in learning ‘evonomics’ — economics from an evolutionary perspective. It will […]

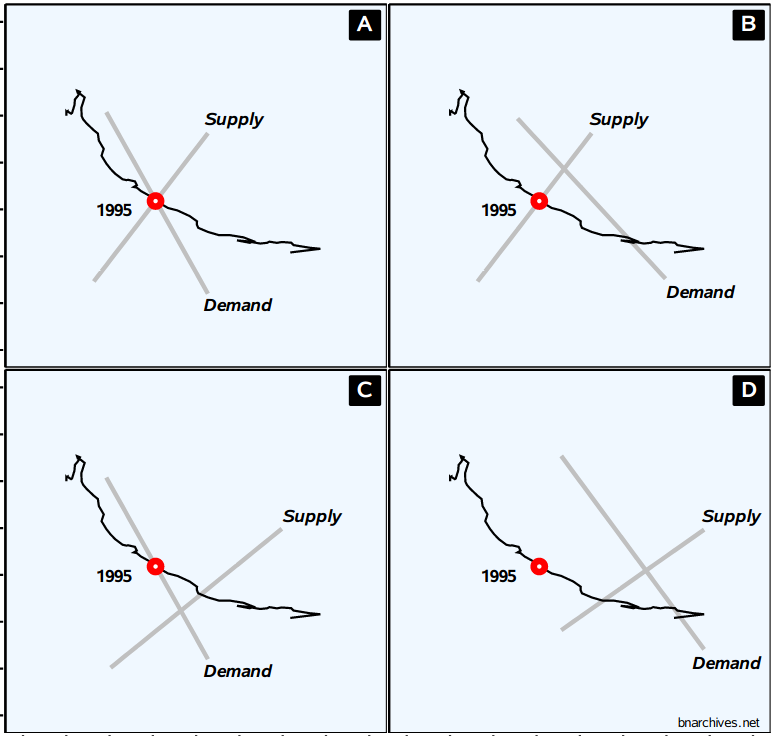

Continue ReadingSupply and Demand Deconstructed

Originally published on Economics from the Top Down Blair Fix Prices are caused by supply and demand, right? So say neoclassical economists. If you’ve bought their fairy tale, I recommend you watch the video below. In it, Jonathan Nitzan demolishes the neoclassical theory of prices. It’s a master lesson in how to deconstruct a theory. […]

Continue ReadingBichler & Nitzan, ‘Unbridgeable: why political economists cannot accept capital as power’

Abstract The theory of capital as power (CasP) is radically different from conventional political economy. In the conventional view, mainstream as well as heterodox, capital is seen a ‘real’ economic entity engaged in the production of goods and services, and capitalism is thought of as a mode of production and consumption. Finance in this approach […]

Continue Reading2021/03: Bichler and Nitzan, ‘The 1-2-3 Toolbox of Mainstream Economics: Promising Everything, Delivering Nothing’

Abstract We write this essay for both lay readers and scientists, though mainstream economists are welcome to enjoy it too. Our subject is the basic toolbox of mainstream economics. The most important tools in this box are demand, supply and equilibrium. All mainstream economists – as well as many heterodox ones – use these tools, […]

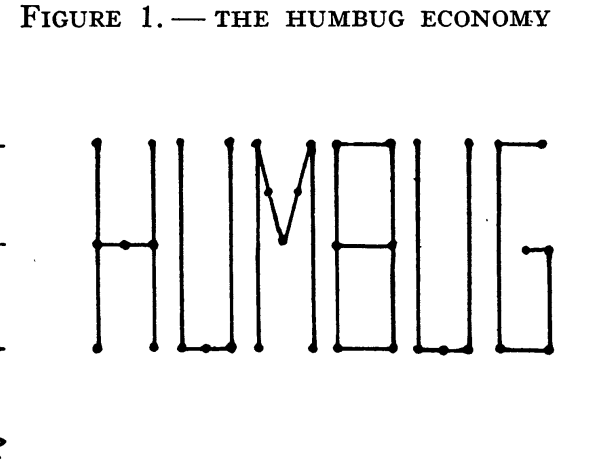

Continue ReadingEconomic Growth Theory … Bah Humbug!

Originally published on Economics from the Top Down Blair Fix I’ve written a lot on this blog about the absurdity of marginal productivity theory. But I haven’t said much about the other pillar of mainstream economics: neoclassical growth theory. Today I’ll break that silence. Neoclassical growth theory is a textbook example of Murphy’s law. Everything […]

Continue ReadingAn Evolutionary Theory of Resource Distribution (Part 1)

Originally published on Economics from the Top Down Blair Fix The biologist Theodosius Dobzhansky famously wrote that “nothing in biology makes sense except in the light of evolution”. I propose a corollary in economics: nothing in economics makes sense except in the light of human social evolution. [1] I explore here how the evolution of […]

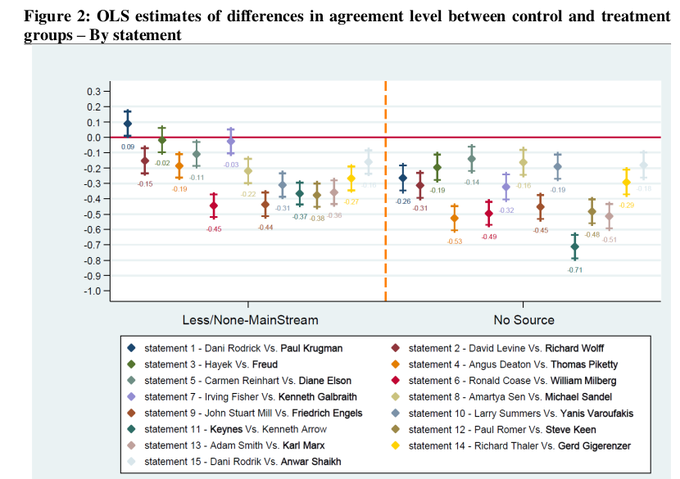

Continue ReadingTribalism in Science (and Economics)

Originally published on Economics from the Top Down Blair Fix If you ask the average person what ‘science’ is, they’ll probably answer something like ‘it’s what we know about the world’. To the lay person, ‘science’ is a body of facts. To the trained scientist, however, ‘science’ means something different. It’s not a body of […]

Continue ReadingWhere’s the Barefoot Revolution in Economics?

Originally published on Economics from the Top Down Blair Fix Yesterday I was reminded of what got me interested in economics. I’ll preface this by saying that I make my living as a substitute teacher in Toronto. It’s not glamorous, but it pays the bills. It gives me time to do research from outside academia. […]

Continue ReadingDiMuzio & Dow, ‘Uneven and Combined Confusion’

Abstract This article offers a critique of Alexander Anievas and Kerem Nişancioğlu’s “How the West came to rule: the geopolitical origins of capitalism”. We argue that while all historiography features a number of silences, shortcomings or omissions, the omissions in How the West came to rule lead to a mistaken view of the emergence of […]

Continue ReadingBichler & Nitzan, ‘A CasP Model of the Stock Market’

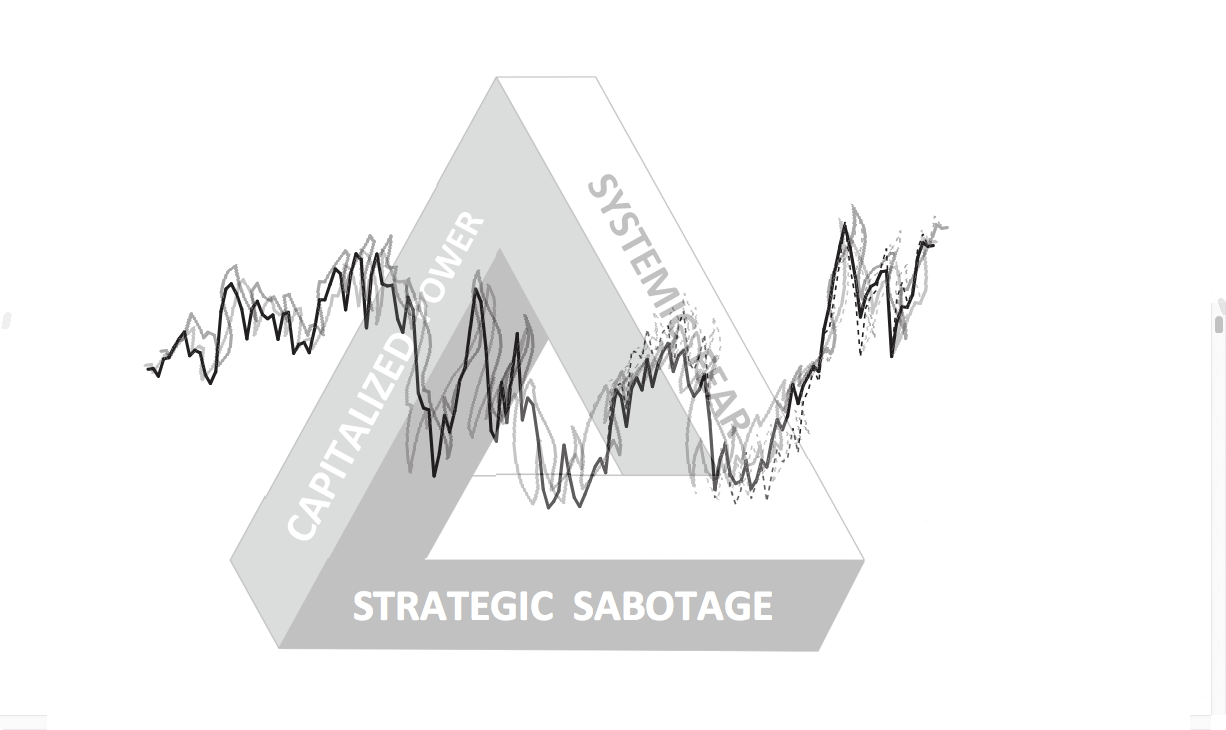

Abstract Most explanations of stock market booms and busts are based on contrasting the underlying ‘fundamental’ logic of the economy with the exogenous, non-economic factors that presumably distort it. Our paper offers a radically different model, examining the stock market not from the mechanical viewpoint of a distorted economy, but from the dialectical perspective of […]

Continue ReadingFrom Global Oil Politics to Desire via Gas Prices

DT Cochrane The Globe & Mail is reporting that the average fuel efficiency of new vehicles sold in 2014 dropped for the first time since 2011. The coverage suggests this is a response to falling prices at the gas pump. First, without access to the relevant data for a longer time period, it is difficult […]

Continue ReadingNo. 2015/03: Bichler & Nitzan, ‘Capital Accumulation: Fiction and Reality’

Abstract What do economists mean when they talk about ‘capital accumulation’? Surprisingly, the answer to this question is anything but clear, and it seems the most unclear in times of turmoil. Consider the recent ‘financial crisis’. The very term already attests to the presumed nature and causes of the crisis, which most observers indeed believe […]

Continue ReadingNo. 2014/05: Fix, ‘Putting Power Back Into Growth Theory’

Abstract Neoclassical growth theory assumes that economic growth is an atomistic process in which changes in distribution play no role. Unfortunately, when this assumption is tested against real-world evidence, it is systematically violated. This paper argues that a reality-based growth theory must reject neoclassical principles in favour of a power-centered approach. Building on Nitzan and […]

Continue ReadingFix, ‘Rethinking Economic Growth Theory From a Biophysical Perspective’

Abstract Neoclassical growth theory is the dominant perspective for explaining economic growth. At its core are four implicit assumptions: 1) economic output can become decoupled from energy consumption; 2) economic distribution is unrelated to growth; 3) large institutions are not important for growth; and 4) labor force structure is not important for growth. Drawing on […]

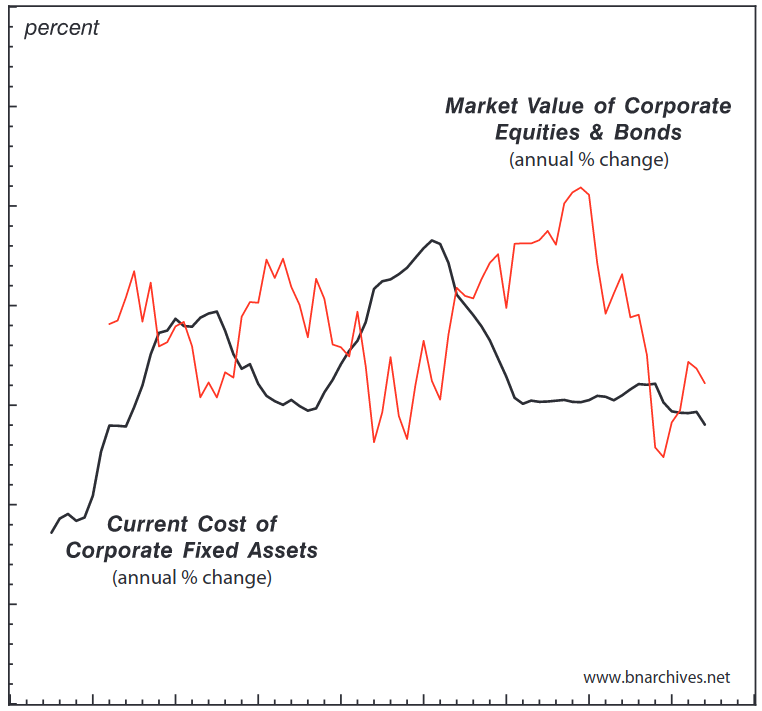

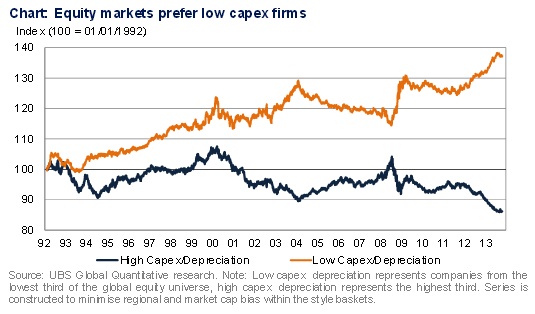

Continue ReadingLow Capex, High Market Cap: A New High for Corporate Sabotage?

Edward Lam Found amongst some recent market commentary the chart above seems to be quite striking evidence in favour of the Capital as Power framework. The data series have been put together by the investment bank UBS, based on their broad (though not comprehensive) global stock coverage. UBS has charted two lines: a) the stock […]

Continue Reading